Question: need help in preparing a t account . i posted the ledger to guide you in the t account During 2021, the company had the

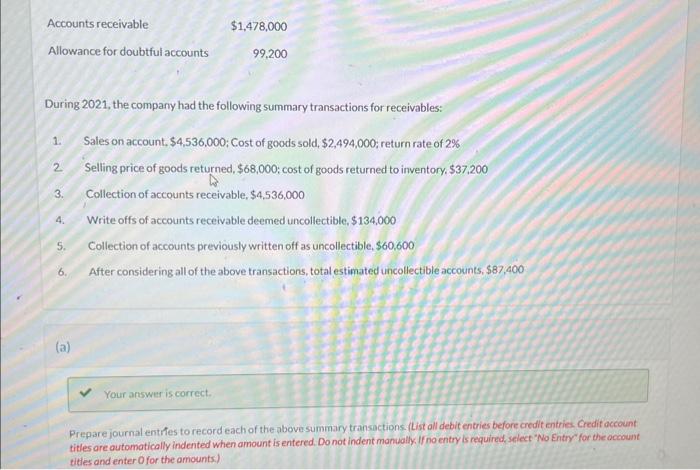

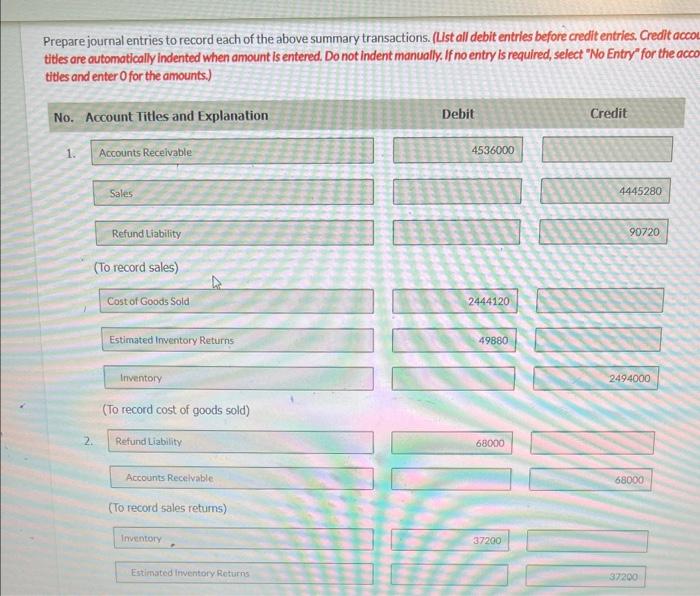

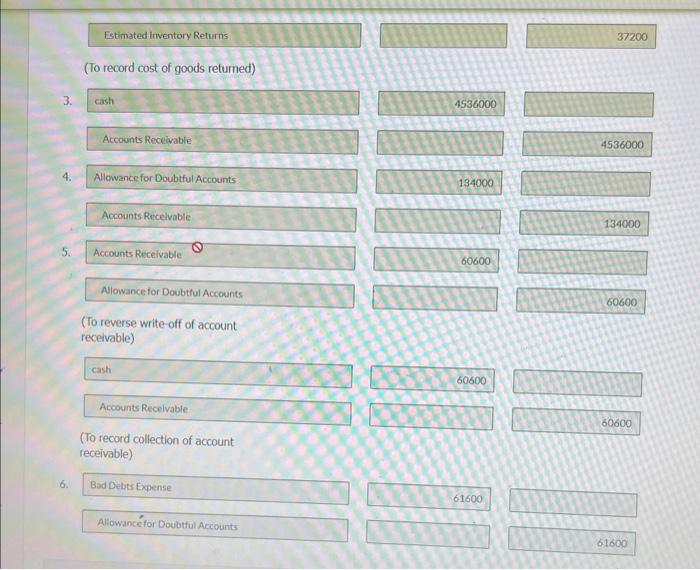

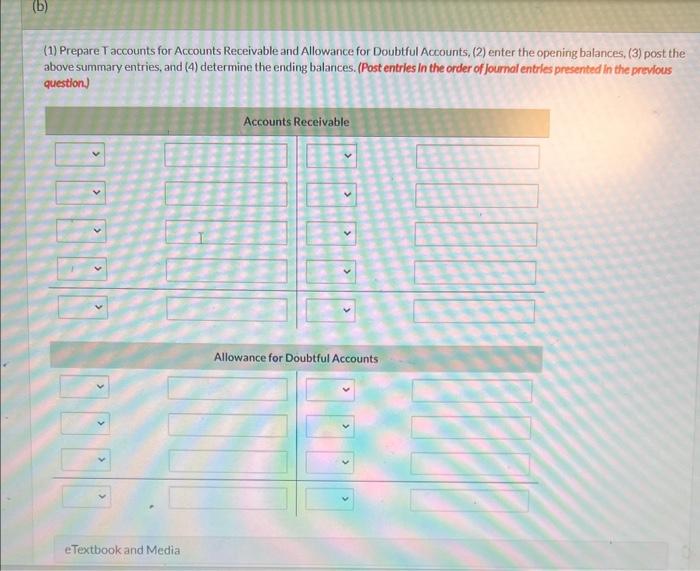

During 2021, the company had the following summary transactions for receivables: 1. Sales on account, $4,536,000; Cost of goods sold, $2,494,000; return rate of 2% 2. Selling price of goods returned, $68,000; cost of goods returned to inventory, $37,200 3. Collection of accounts receivable, $4,536,000 4. Write offs of accounts receivable deemed uncollectible, $134,000 5. Collection of accounts previously written off as uncollectible, $60,600 6. After considering all of the above transactions, total estimated uncollectible accounts, $87,400 (3) Your answer is correct. Prepare journal enthes to record each of the above summary transactions. (List all debit entries before credit entries: Credif occount titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the occount titles and enter O for the amounts.) Prepare journal entries to record each of the above summary transactions. (List all debit entries before credit entries. Credit acco titles are cutomotically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the aca titles and enter 0 for the amounts.) Estimated imentory Returns (To record cost of goods returned) 3. cash 4. Allowance for Doubtful Accounts 134000 5. Accounts Recelvable 60600 Alowance for Doubtful Accounts (To reverse write-off of account receivable) (To record collection of account receivable) 6. \begin{tabular}{|lr|} \hline Bad Debits Expense & 61600 \\ \hline \end{tabular} Allowancfor Doubtful Accounts (1) Prepare Taccounts for Accounts Receivable and Allowance for Doubtful Accounts, (2) enter the opening balances, (3) post the above summary entries, and (4) determine the ending balances. (Post entries in the order of joumal entrles presented in the prevlous question.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts