Question: need help in problems e to h please You work for a small investment management firm. You have been provided with the following historical information

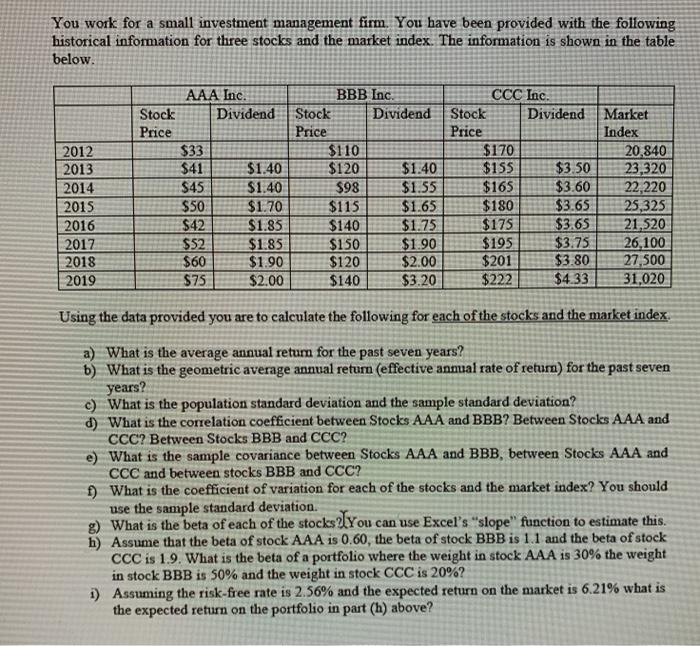

You work for a small investment management firm. You have been provided with the following historical information for three stocks and the market index. The information is shown in the table below 2012 2013 2014 2015 2016 2017 2018 2019 AAA Inc. Stock Dividend Price $33 $41 $1.40 $45 $1.40 $50 $1.70 $42 $1.85 $52 $1.85 $60 $1.90 $75 $2.00 BBB Inc. Stock Dividend Price $110 $120 $1.40 $98 $1.55 $115 $1.65 $140 $1.75 $150 $1.90 $120 $2.00 $140 $3.20 CCC Inc. Stock Dividend Market Price Index $170 20,840 $155 $3.50 23,320 $165 $3.60 22,220 $180 $3.65 25,325 $175 $3.65 21.520 $195 $3.75 26,100 $201 $3.80 27,500 $222 $4.33 31,020 Using the data provided you are to calculate the following for each of the stocks and the market index. a) What is the average annual return for the past seven years? b) What is the geometric average annual return (effective annual rate of return) for the past seven years? c) What is the population standard deviation and the sample standard deviation? d) What is the correlation coefficient between Stocks AAA and BBB? Between Stocks AAA and CCC? Between Stocks BBB and CCC? e) What is the sample covariance between Stocks AAA and BBB, between Stocks AAA and CCC and between stocks BBB and CCC? 1) What is the coefficient of variation for each of the stocks and the market index? You should use the sample standard deviation. 3) What is the beta of each of the stocks you can use Excel's "slope" function to estimate this. h) Assume that the beta of stock AAA is 0.60, the beta of stock BBB is 1.1 and the beta of stock CCC is 1.9. What is the beta of a portfolio where the weight in stock AAA is 30% the weight in stock BBB is 50% and the weight in stock CCC is 20%? 1) Assuming the risk-free rate is 2.56% and the expected return on the market is 6.21% what is the expected return on the portfolio in part (h) above

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts