Question: need help in question 7 Q6. Using the Dividend Discount Model (DDM), what is the expected stock price for a company with a current dividend

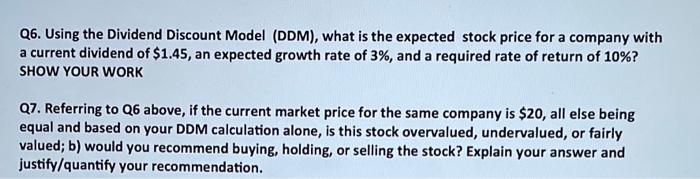

Q6. Using the Dividend Discount Model (DDM), what is the expected stock price for a company with a current dividend of $1.45, an expected growth rate of 3%, and a required rate of return of 10%? SHOW YOUR WORK Q7. Referring to Q6 above, if the current market price for the same company is $20, all else being equal and based on your DDM calculation alone, is this stock overvalued, undervalued, or fairly valued; b) would you recommend buying, holding, or selling the stock? Explain your answer and justify/quantify your recommendation

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts