Question: Need help making a ratio analyses from the income statement and balance provided below. ratio analyzes need to have: liquidity ratios, efficiency ratios, leverage ratios,

Need help making a ratio analyses from the income statement and balance provided below. ratio analyzes need to have: liquidity ratios, efficiency ratios, leverage ratios, profitability ratios, market value ratios and dupont equation.Price per share (in the ratio analyses are 2022 $65.00, 2021 $68.00 and 2020 $71.00

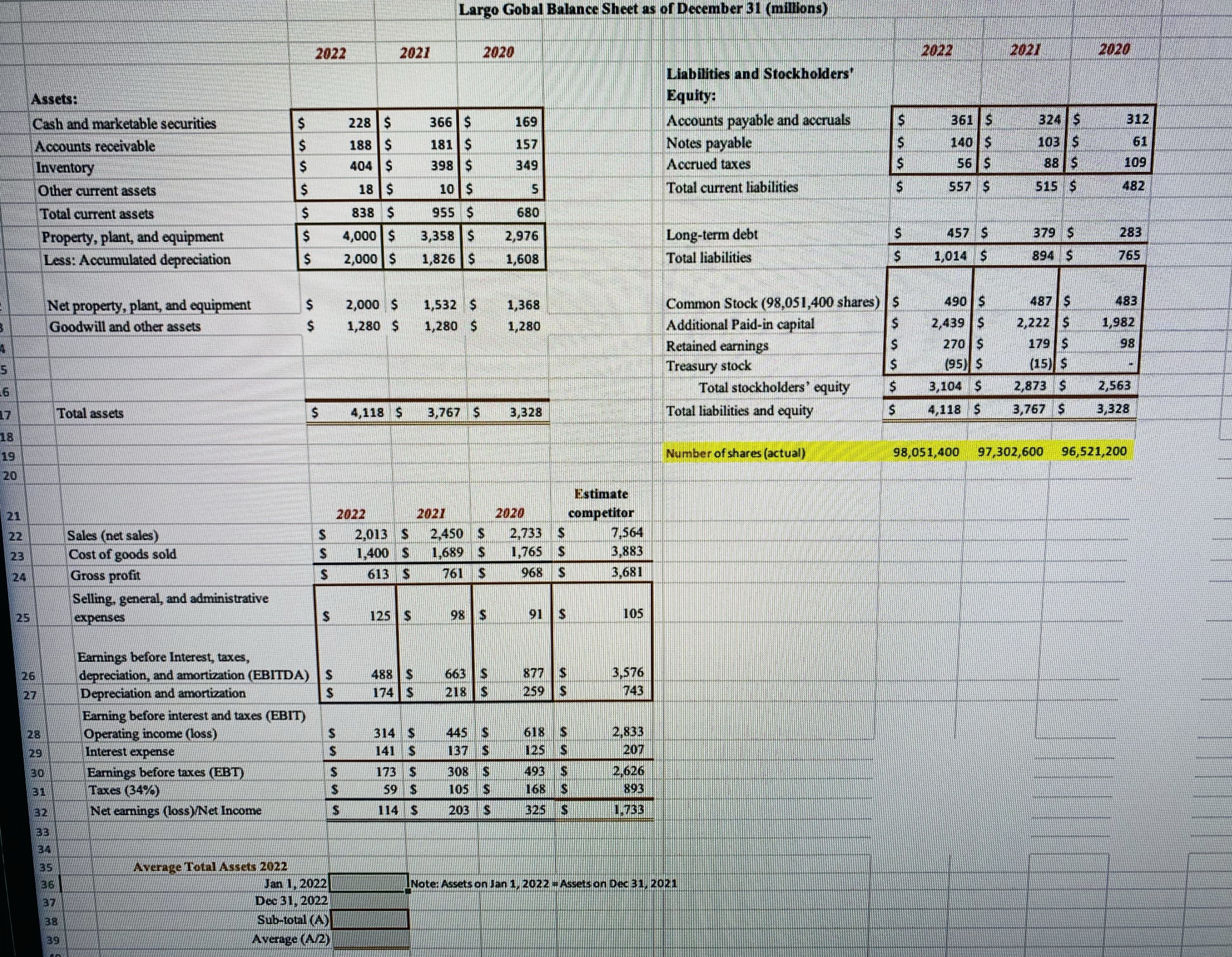

Largo Gobal Balance Sheet as of December 31 (millions) 2022 2021 2020 2022 202 2020 Liabilities and Stockholders' Assets: Equity: Cash and marketable securities $ 366 S 169 Accounts payable and accruals 361 324 312 Accounts receivable 181 $ 157 Notes payable 140 S 103 | $ 61 Inventory IS 398 | $ 349 Accrued taxes 56 S 88 5 109 Other current assets 18 5 10 s Total current liabilities S 557 $ 515 $ 482 Total current assets 838 $ 955 $ 680 Property, plant, and equipment ,000 s 3,358 2,976 Long-term debt S 457 5 379 $ 283 Less: Accumulated depreciation 2,000 1,826 s 1,608 Total liabilities S 1,014 S 894 $ 765 Net property, plant, and equipment 2,000 S 1,532 $ 1,368 Common Stock (98,051,400 shares) 490 5 487 5 483 in un Goodwill and other assets 1,280 $ 1,280 1,280 Additional Paid-in capital 2,439 S 2,222 | $ 1,982 Retained earnings 270 $ 179 | $ 98 Treasury stock (15) S Total stockholders equity 3,104 S 2,873 $ 2,563 Total assets $ 4,118 5 3,767 5 3,328 Total liabilities and equity S 4,118 5 3,767 5 3,328 19 Number of shares (actual) 98,051,400 97,302,600 96,521,200 20 Estimate 21 2022 2021 2020 competitor 22 Sales (net sales) S 2,013 $ 2,450 $ 2,733 S 7,564 23 Cost of goods sold 1,400 S 1,689 $ 1,765 5 3,883 Gross profit S 513 S 761 S 968 S 3,681 Selling, general, and administrative 25 expenses S 125 | $ 98 105 Earnings before Interest, taxes, 26 depreciation, and amortization (EBITDA) S 488 $ 663 S 877 3,576 Depreciation and amortization 174 $ 218 259 743 Earning before interest and taxes (EBIT) 28 Operating income (loss) 314 $ 445 S 618 S 2,833 29 Interest expense 141 S 137 S 125 S 207 30 Earnings before taxes (EBT) S 173 $ 308 S 493 $ 2,626 31 Taxes (34%) IS 59 S 105 168 893 32 Net earnings (loss )/Net Income S 114 S 203 S 325 $ 1.733 33 34 35 Average Total Assets 2022 36 Jan 1, 2022 Note: Assets on Jan 1, 2022 - Assets on Dec 31, 2021 37 Dec 31, 2022 38 Sub-total (A) Average (A/2)