Question: Need help making General Journal (Question 1) Side Notes 2-bank loan was $350,000 3-Total cost paid in advance= $4,000 for four months 5-Weekly salary for

Need help making General Journal (Question 1)

Side Notes

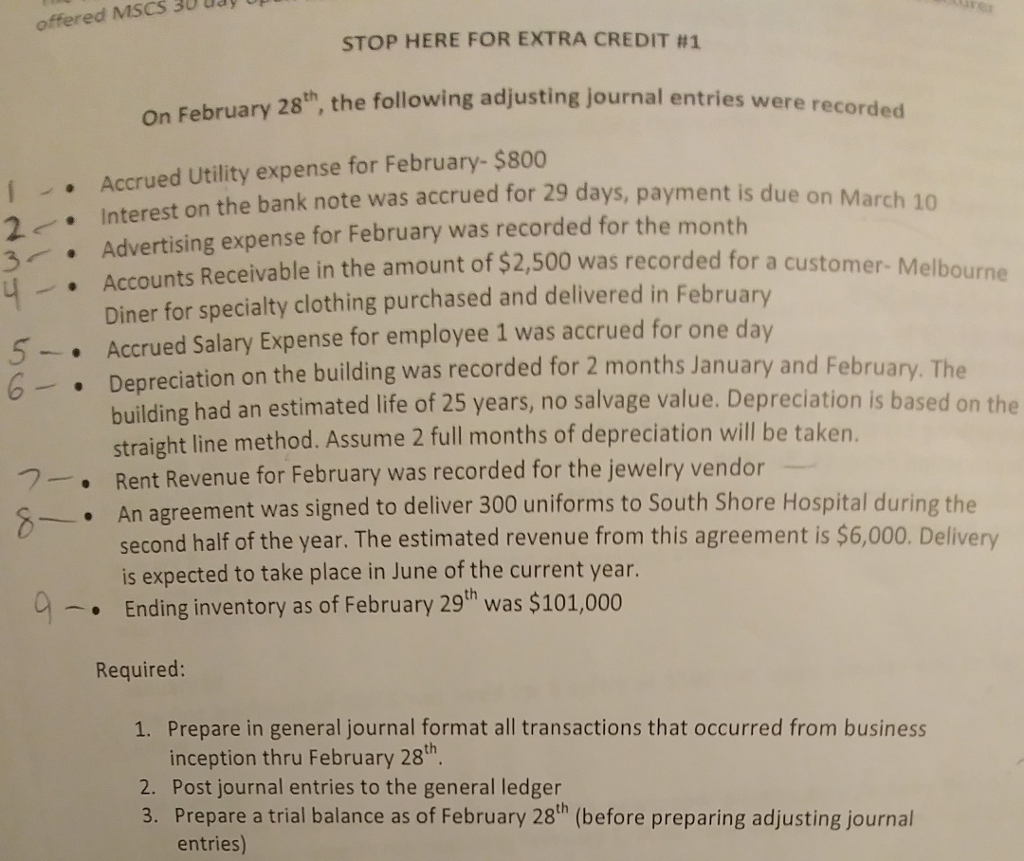

2-bank loan was $350,000

3-Total cost paid in advance= $4,000 for four months

5-Weekly salary for employee 1 is $500 per week

6-building purchased for/worth $300,000 when bought

7-Rent began feb.1 for $2,000 per month;recieved 5 months rent in advance- $10,000

day ep offered MSCS 30 STOP HERE FOR EXTRA CREDIT #1 uary 28th, the following adjusting journal entries were record On Febr ed Accrued Utility expense for February- $800 on the bank note was accrued for 29 days, payment is due on March 10 2. 3 Advertising expense for February was recorded for the month Accounts Receivable in the amount of $2,500 was recorded for a customer- Melb Diner for specialty clothing purchased and delivered in February 5Accrued Salary Expense for employee 1 was accrued for one day 6-Depreciation on the building was recorded for 2 months January and Febru February. The building had an estimated life of 25 years, no straight line method. Assume 2 full months of depreciation will be taken. Rent Revenue for February was recorded for the jewelry vendor An agreement was signed to deliver 300 uniforms to South Shore Hospital during the second half of the year. The estimated revenue from this agreement is $6,000. Delivery is expected to take place in June of the current year. Ending inventory as of February 29th was $101,000 salvage value. Depreciation is based on the . Required: Prepare in general journal format all transactions that occurred from business inception thru February 28h 1. 2. Post journal entries to the general ledger 3. Prepare a trial balance as of February 28th (before preparing adjusting journal entries)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts