Question: Need help mostly on adjusting entries, but help on the rest would be helpful. Sunny's Emporium had the following transactions in April, 2024, the final

Need help mostly on adjusting entries, but help on the rest would be helpful.

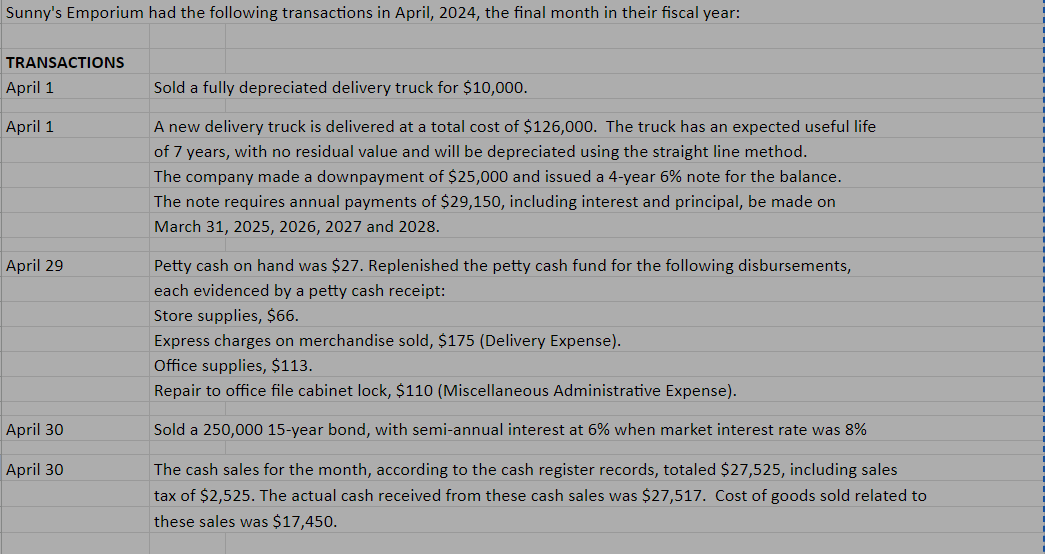

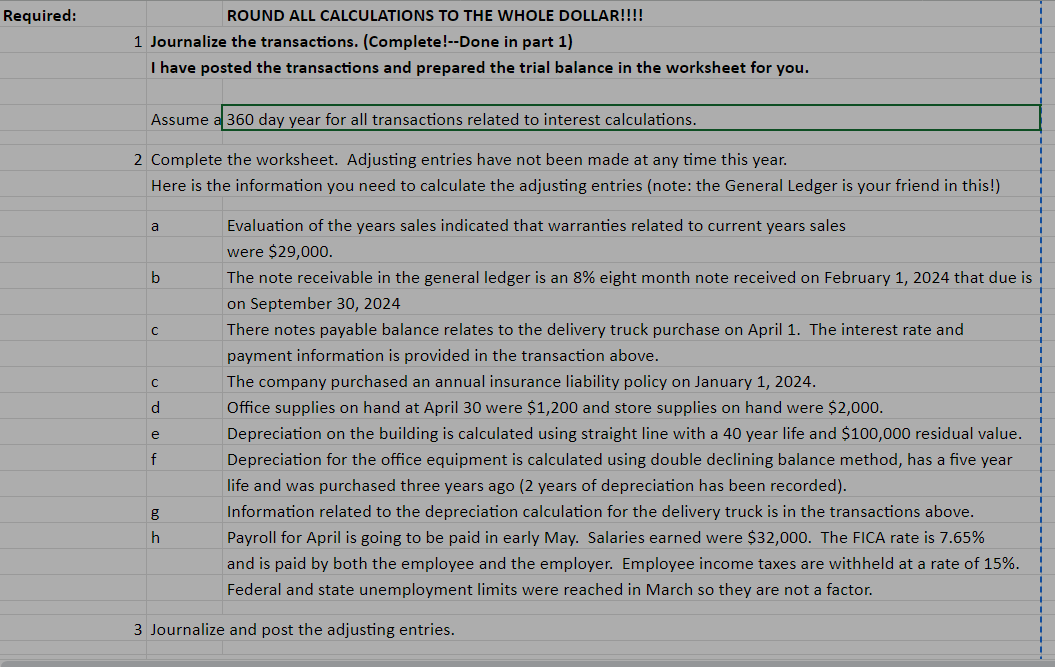

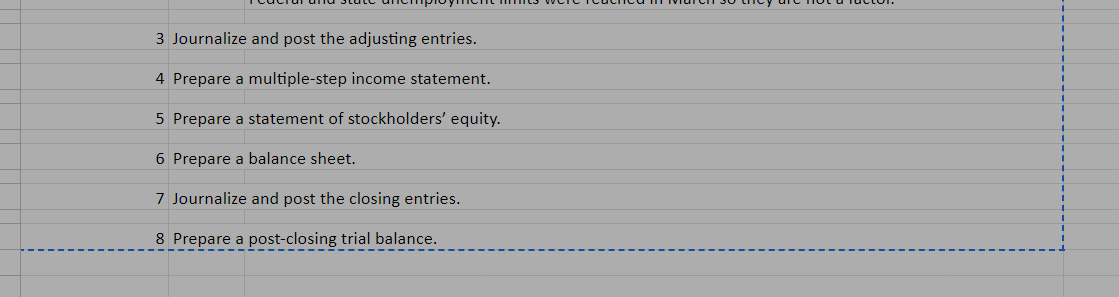

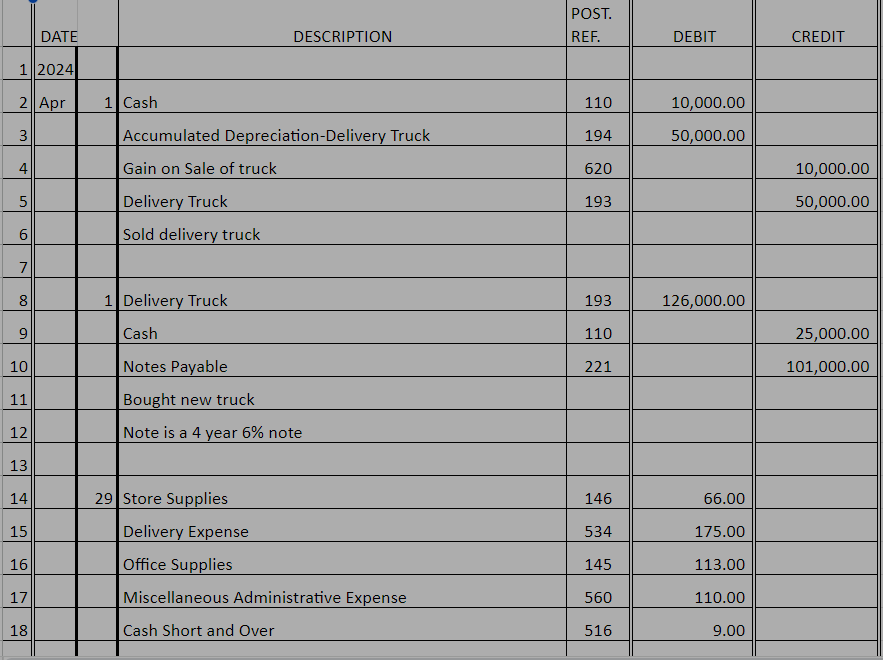

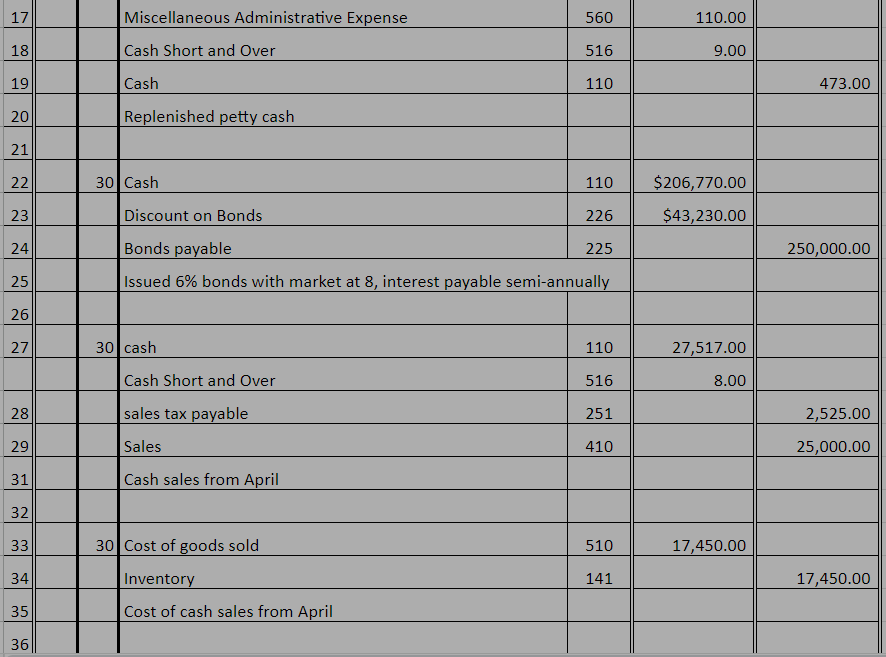

Sunny's Emporium had the following transactions in April, 2024, the final month in their fiscal year: TRANSACTIONS April 1 April 1 April 29 Sold a fully depreciated delivery truck for $10,000. A new delivery truck is delivered at a total cost of $126,000. The truck has an expected useful life of 7 years, with no residual value and will be depreciated using the straight line method. The company made a downpayment of $25,000 and issued a 4-year 6% note for the balance. The note requires annual payments of $29,150, including interest and principal, be made on March 31, 2025, 2026, 2027 and 2028. Petty cash on hand was $27. Replenished the petty cash fund for the following disbursements, each evidenced by a petty cash receipt: Store supplies, $66. Express charges on merchandise sold, $175 (Delivery Expense). Office supplies, $113. Repair to office file cabinet lock, $110 (Miscellaneous Administrative Expense). April 30 Sold a 250,000 15-year bond, with semi-annual interest at 6% when market interest rate was 8% April 30 The cash sales for the month, according to the cash register records, totaled $27,525, including sales tax of $2,525. The actual cash received from these cash sales was $27,517. Cost of goods sold related to these sales was $17,450.

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts