Question: Need help! New-Project Analysis The Campbell Company is considering adding a robotic paint Sprayer to its production line. The sprayer's base price is $830,000, and

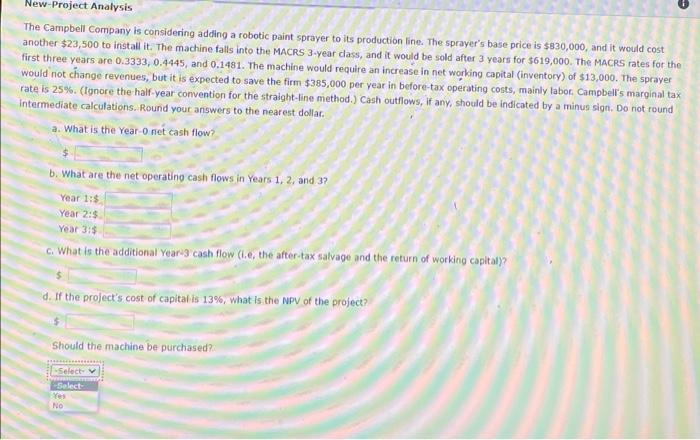

New-Project Analysis The Campbell Company is considering adding a robotic paint Sprayer to its production line. The sprayer's base price is $830,000, and it would cost another $23,500 to install it. The machine falls into the MACRS 3-year cass, and it would be sold after 3 years for $619,000. The MACRS rates for the first three years are 0.3333, 0.4445, and 0.1481. The machine would require an increase in net working capital (inventory) of $13,000. The sprayer would not change revenues, but it is expected to save the firm $385,000 per year in before-tax operating costs, mainly labor Campbell's marginal tax rate is 25%. (Ignore the half-year convention for the straight-line method.) Cash outflows, if any, should be indicated by a minus sign, Do not found Intermediate calculations. Round your answers to the nearest dollar. a. What is the Year Onet cash flow? b. What are the net operating cash flows in Years 1, 2, and 3? Year 1:$ Year 2:5 Year 3:5 c. What is the additional Year 3 cash flow (le, the after tax salvage and the return of working capital)? d. If the project's cost of capital is 13%, what is the NPV of the project? Should the machine be purchased? Select Select Yes NO

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts