Question: Need help on 1,2,& 3. If only one can be answered then I would prefer #1. ANALYSIS Use the completed balance sheet and income statement

Need help on 1,2,& 3. If only one can be answered then I would prefer #1.

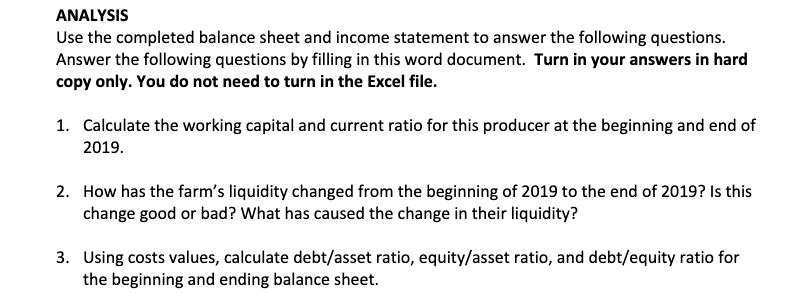

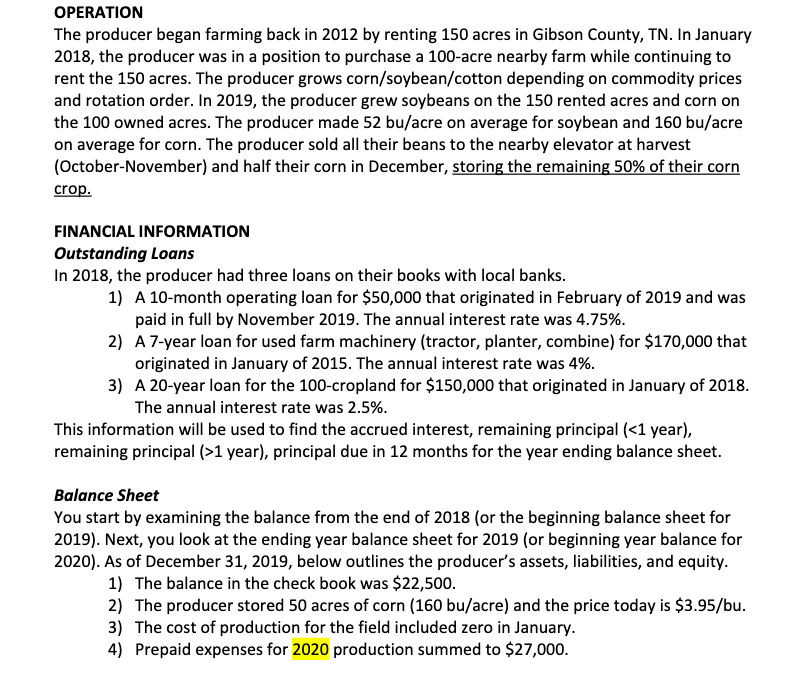

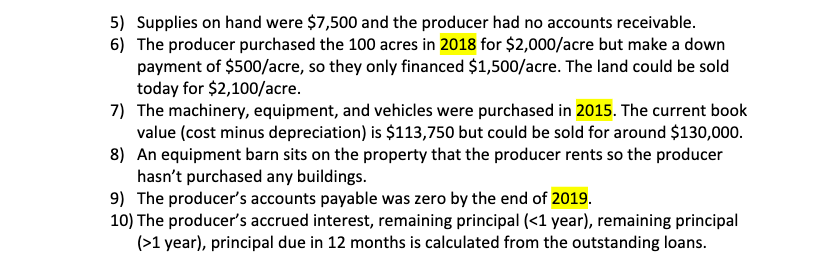

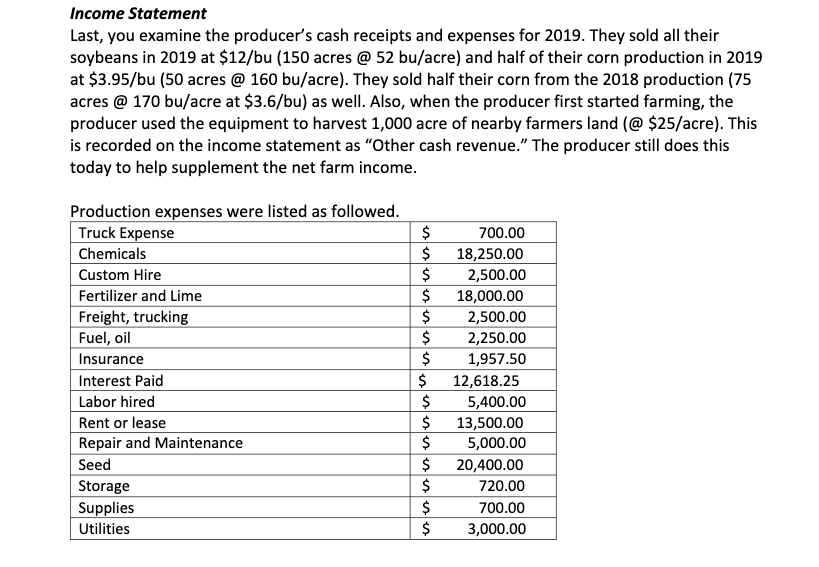

ANALYSIS Use the completed balance sheet and income statement to answer the following questions. Answer the following questions by filling in this word document. Turn in your answers in hard copy only. You do not need to turn in the Excel file. 1. Calculate the working capital and current ratio for this producer at the beginning and end of 2019. 2. How has the farm's liquidity changed from the beginning of 2019 to the end of 2019? Is this change good or bad? What has caused the change in their liquidity? 3. Using costs values, calculate debt/asset ratio, equity/asset ratio, and debt/equity ratio for the beginning and ending balance sheet. OPERATION The producer began farming back in 2012 by renting 150 acres in Gibson County, TN. In January 2018, the producer was in a position to purchase a 100-acre nearby farm while continuing to rent the 150 acres. The producer grows corn/soybean/cotton depending on commodity prices and rotation order. In 2019, the producer grew soybeans on the 150 rented acres and corn on the 100 owned acres. The producer made 52 bu/acre on average for soybean and 160 bu/acre on average for corn. The producer sold all their beans to the nearby elevator at harvest (October November) and half their corn in December, storing the remaining 50% of their corn crop. FINANCIAL INFORMATION Outstanding Loans In 2018, the producer had three loans on their books with local banks. 1) A 10-month operating loan for $50,000 that originated in February of 2019 and was paid in full by November 2019. The annual interest rate was 4.75%. 2) A 7-year loan for used farm machinery (tractor, planter, combine) for $170,000 that originated in January of 2015. The annual interest rate was 4%. 3) A 20-year loan for the 100-cropland for $150,000 that originated in January of 2018. The annual interest rate was 2.5%. This information will be used to find the accrued interest, remaining principal (1 year), principal due in 12 months for the year ending balance sheet. Balance Sheet You start by examining the balance from the end of 2018 (or the beginning balance sheet for 2019). Next, you look at the ending year balance sheet for 2019 (or beginning year balance for 2020). As of December 31, 2019, below outlines the producer's assets, liabilities, and equity. 1) The balance in the check book was $22,500. 2) The producer stored 50 acres of corn (160 bu/acre) and the price today is $3.95/bu. 3) The cost of production for the field included zero in January. 4) Prepaid expenses for 2020 production summed to $27,000. 5) Supplies on hand were $7,500 and the producer had no accounts receivable. 6) The producer purchased the 100 acres in 2018 for $2,000/acre but make a down payment of $500/acre, so they only financed $1,500/acre. The land could be sold today for $2,100/acre. 7) The machinery, equipment, and vehicles were purchased in 2015. The current book value (cost minus depreciation) is $113,750 but could be sold for around $130,000. 8) An equipment barn sits on the property that the producer rents so the producer hasn't purchased any buildings. 9) The producer's accounts payable was zero by the end of 2019. 10) The producer's accrued interest, remaining principal (1 year), principal due in 12 months is calculated from the outstanding loans. ANALYSIS Use the completed balance sheet and income statement to answer the following questions. Answer the following questions by filling in this word document. Turn in your answers in hard copy only. You do not need to turn in the Excel file. 1. Calculate the working capital and current ratio for this producer at the beginning and end of 2019. 2. How has the farm's liquidity changed from the beginning of 2019 to the end of 2019? Is this change good or bad? What has caused the change in their liquidity? 3. Using costs values, calculate debt/asset ratio, equity/asset ratio, and debt/equity ratio for the beginning and ending balance sheet. OPERATION The producer began farming back in 2012 by renting 150 acres in Gibson County, TN. In January 2018, the producer was in a position to purchase a 100-acre nearby farm while continuing to rent the 150 acres. The producer grows corn/soybean/cotton depending on commodity prices and rotation order. In 2019, the producer grew soybeans on the 150 rented acres and corn on the 100 owned acres. The producer made 52 bu/acre on average for soybean and 160 bu/acre on average for corn. The producer sold all their beans to the nearby elevator at harvest (October November) and half their corn in December, storing the remaining 50% of their corn crop. FINANCIAL INFORMATION Outstanding Loans In 2018, the producer had three loans on their books with local banks. 1) A 10-month operating loan for $50,000 that originated in February of 2019 and was paid in full by November 2019. The annual interest rate was 4.75%. 2) A 7-year loan for used farm machinery (tractor, planter, combine) for $170,000 that originated in January of 2015. The annual interest rate was 4%. 3) A 20-year loan for the 100-cropland for $150,000 that originated in January of 2018. The annual interest rate was 2.5%. This information will be used to find the accrued interest, remaining principal (1 year), principal due in 12 months for the year ending balance sheet. Balance Sheet You start by examining the balance from the end of 2018 (or the beginning balance sheet for 2019). Next, you look at the ending year balance sheet for 2019 (or beginning year balance for 2020). As of December 31, 2019, below outlines the producer's assets, liabilities, and equity. 1) The balance in the check book was $22,500. 2) The producer stored 50 acres of corn (160 bu/acre) and the price today is $3.95/bu. 3) The cost of production for the field included zero in January. 4) Prepaid expenses for 2020 production summed to $27,000. 5) Supplies on hand were $7,500 and the producer had no accounts receivable. 6) The producer purchased the 100 acres in 2018 for $2,000/acre but make a down payment of $500/acre, so they only financed $1,500/acre. The land could be sold today for $2,100/acre. 7) The machinery, equipment, and vehicles were purchased in 2015. The current book value (cost minus depreciation) is $113,750 but could be sold for around $130,000. 8) An equipment barn sits on the property that the producer rents so the producer hasn't purchased any buildings. 9) The producer's accounts payable was zero by the end of 2019. 10) The producer's accrued interest, remaining principal (1 year), principal due in 12 months is calculated from the outstanding loans

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts