Question: need help on 13 and 14 Question 13 (2 points) If an investor diversifies away the maximum possible risk in a portfolio, then the portfolio

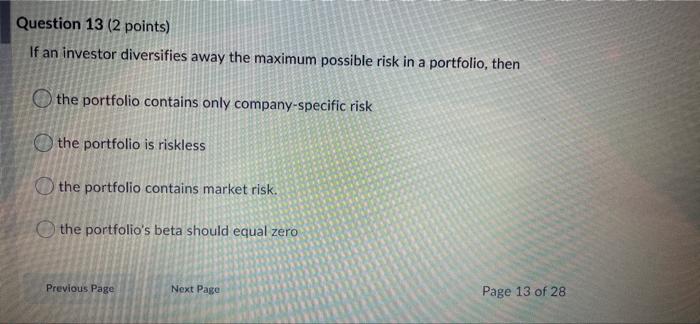

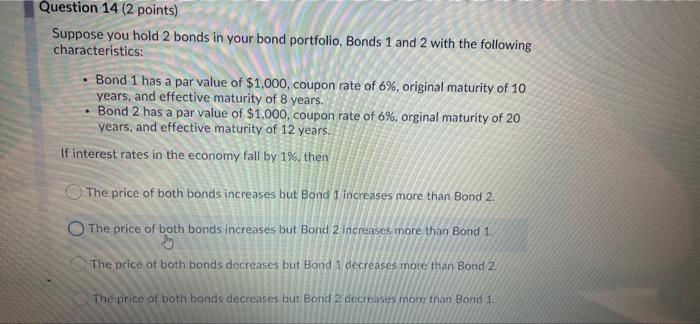

Question 13 (2 points) If an investor diversifies away the maximum possible risk in a portfolio, then the portfolio contains only company-specific risk the portfolio is riskless the portfolio contains market risk. the portfolio's beta should equal zero Previous Page Next Page Page 13 of 28 Question 14 (2 points) Suppose you hold 2 bonds in your bond portfolio, Bonds 1 and 2 with the following characteristics: Bond 1 has a par value of $1,000, coupon rate of 6%, original maturity of 10 years, and effective maturity of 8 years. Bond 2 has a par value of $1,000, coupon rate of 6%, orginal maturity of 20 years, and effective maturity of 12 years. If interest rates in the economy fall by 1%then The price of both bonds increases but Band 1 increases more than Bond 2. The price of both bonds increases but Bond 2 increases more than Bond 1. The price of both bonds decreases but Bond 1 decreases more than Bond 2. The price of both bonds decreases but Bond 2 decreases more than Bond 1

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts