Question: need help on 1-5 Question 1 (1 point) What is the present value of a security that will pay $3,000 in 4 years if securities

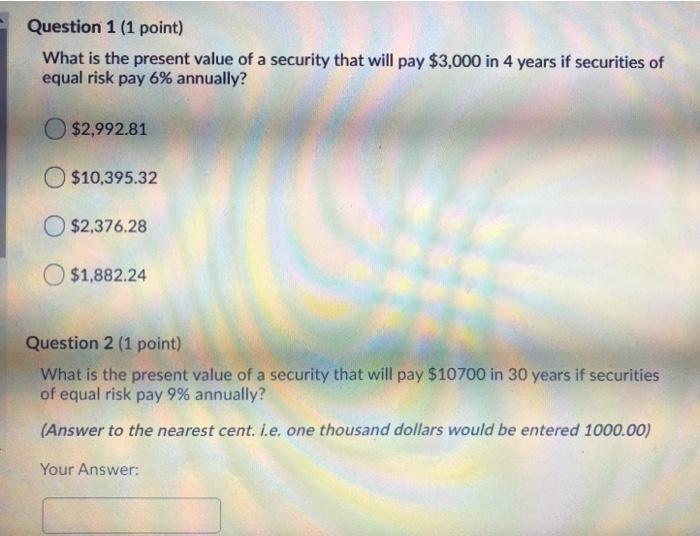

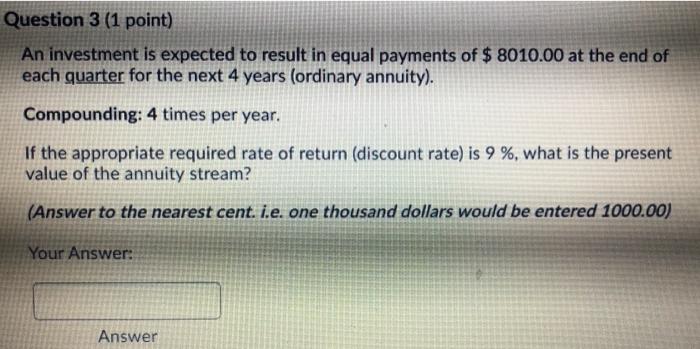

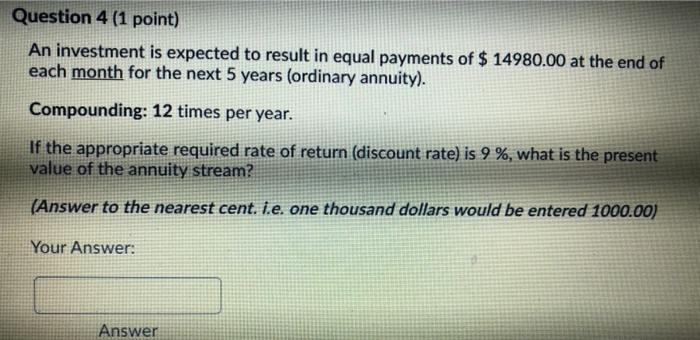

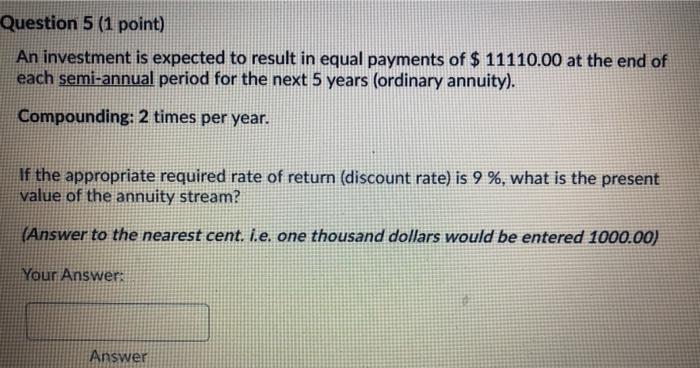

Question 1 (1 point) What is the present value of a security that will pay $3,000 in 4 years if securities of equal risk pay 6% annually? $2,992.81 $10.395.32 $2,376.28 $1,882.24 Question 2 (1 point) What is the present value of a security that will pay $10700 in 30 years if securities of equal risk pay 9% annually? (Answer to the nearest cent. i.e. one thousand dollars would be entered 1000.00) Your Answer: Question 3 (1 point) An investment is expected to result in equal payments of $ 8010.00 at the end of each quarter for the next 4 years (ordinary annuity). Compounding: 4 times per year. If the appropriate required rate of return (discount rate) is 9 %, what is the present value of the annuity stream? (Answer to the nearest cent. i.e. one thousand dollars would be entered 1000.00) Your Answer: Answer Question 4 (1 point) An investment is expected to result in equal payments of $ 14980.00 at the end of each month for the next 5 years (ordinary annuity). Compounding: 12 times per year. If the appropriate required rate of return (discount rate) is 9 %, what is the present value of the annuity stream? (Answer to the nearest cent. i.e. one thousand dollars would be entered 1000.00) Your Answer: Answer Question 5 (1 point) An investment is expected to result in equal payments of $ 11110.00 at the end of each semi-annual period for the next 5 years (ordinary annuity). Compounding: 2 times per year. If the appropriate required rate of return (discount rate) is 9 %, what is the present value of the annuity stream? (Answer to the nearest cent. i.e. one thousand dollars would be entered 1000.00) Your

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts