Question: need help on 4 3. In the current interest rate environment, using a required return estimate based on the short-term government bond rate and a

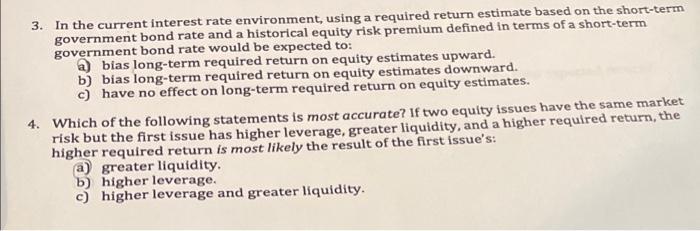

3. In the current interest rate environment, using a required return estimate based on the short-term government bond rate and a historical equity risk premium defined in terms of a short-term government bond rate would be expected to: a) bias long-term required return on equity estimates upward. b) bias long-term required return on equity estimates downward. c) have no effect on long-term required return on equity estimates. 4. Which of the following statements is most accurate? If two equity issues have the same market risk but the first issue has higher leverage, greater liquidity, and a higher required return, the higher required return is most likely the result of the first issue's: greater liquidity. b) higher leverage. c) higher leverage and greater liquidity

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts