Question: need help on 6-11 Question 6 (1 point) You expect to make equal payments of $ 740.00 at the end of each semi-annual period over

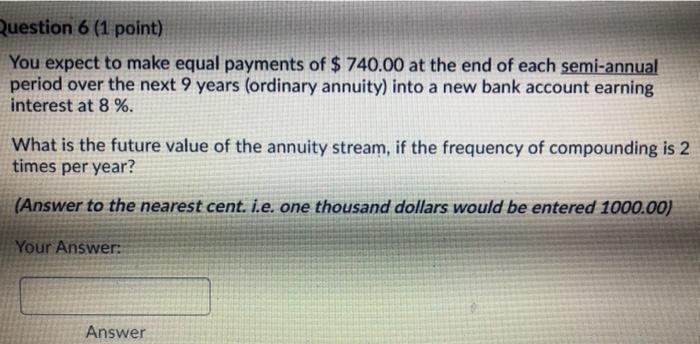

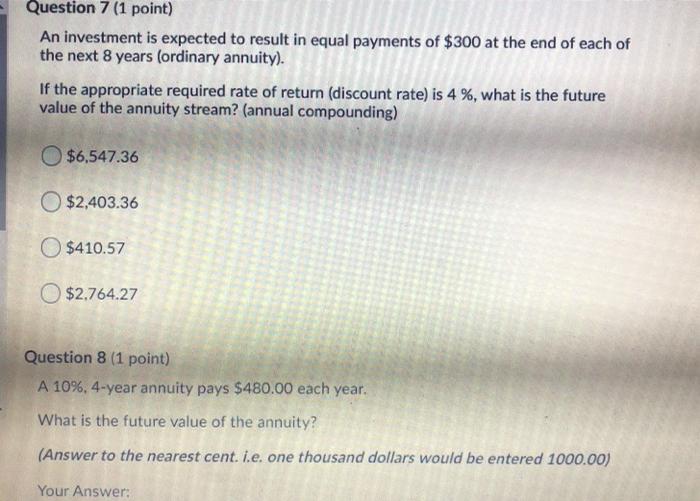

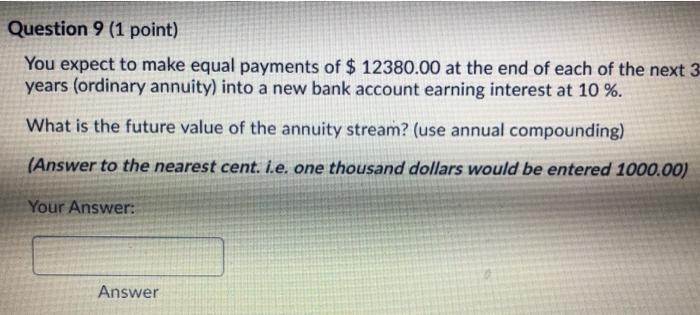

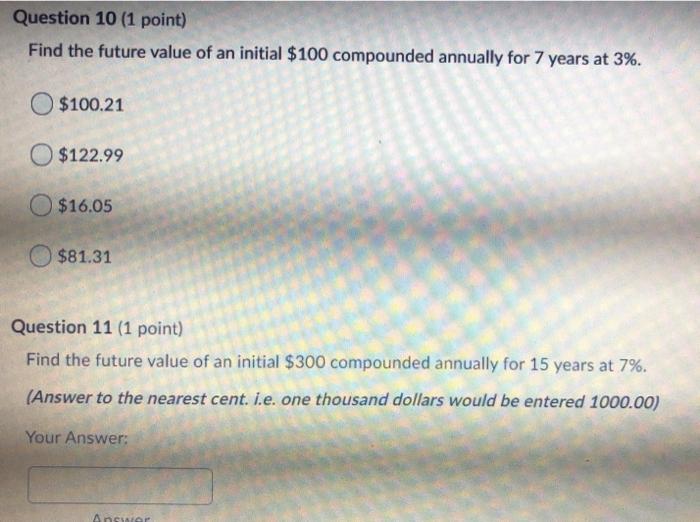

Question 6 (1 point) You expect to make equal payments of $ 740.00 at the end of each semi-annual period over the next 9 years (ordinary annuity) into a new bank account earning interest at 8 %. What is the future value of the annuity stream, if the frequency of compounding is 2 times per year? (Answer to the nearest cent. i.e. one thousand dollars would be entered 1000.00) Your Answer: Answer Question 7 (1 point) An investment is expected to result in equal payments of $300 at the end of each of the next 8 years (ordinary annuity). If the appropriate required rate of return (discount rate) is 4 %, what is the future value of the annuity stream? (annual compounding) $6,547.36 O $2,403.36 $410.57 $2.764.27 Question 8 (1 point) A 10%, 4-year annuity pays $480.00 each year. What is the future value of the annuity? (Answer to the nearest cent. i.e. one thousand dollars would be entered 1000.00) Your Answer: Question 9 (1 point) You expect to make equal payments of $ 12380.00 at the end of each of the next 3 years (ordinary annuity) into a new bank account earning interest at 10 %. What is the future value of the annuity stream? (use annual compounding) (Answer to the nearest cent. i.e. one thousand dollars would be entered 1000.00) Your Answer: Answer Question 10 (1 point) Find the future value of an initial $100 compounded annually for 7 years at 3%. $100.21 $122.99 $16.05 $81.31 Question 11 (1 point) Find the future value of an initial $300 compounded annually for 15 years at 7%. (Answer to the nearest cent. i.e. one thousand dollars would be entered 1000.00) Your Answer: Ansar

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts