Question: need help on 7 and 8 Question 7 (1 point) An individual has $34000 invested in Stock A with a beta of 0.5 and another

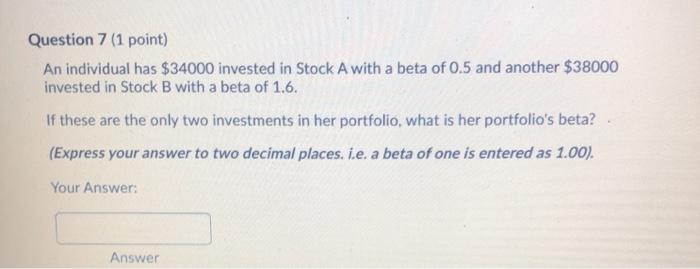

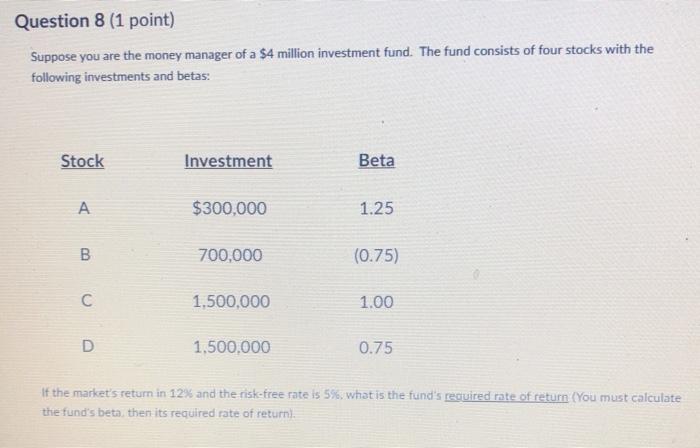

Question 7 (1 point) An individual has $34000 invested in Stock A with a beta of 0.5 and another $38000 invested in Stock B with a beta of 1.6. If these are the only two investments in her portfolio, what is her portfolio's beta? (Express your answer to two decimal places. i.e. a beta of one is entered as 1.00). Your Answer: Answer Question 8 (1 point) Suppose you are the money manager of a $4 million investment fund. The fund consists of four stocks with the following investments and betas: Stock Investment Beta A $300,000 1.25 B 700,000 (0.75) 1.500,000 1.00 D 1,500,000 0.75 If the market's return in 12% and the risk-free rate is 5%. What is the fund's required rate of return (You must calculate the fund's beta then its required rate of return)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts