Question: need help on all 3 please Required information The following information applies to the questions displayed below) Hemming Company reported the following current-year purchases and

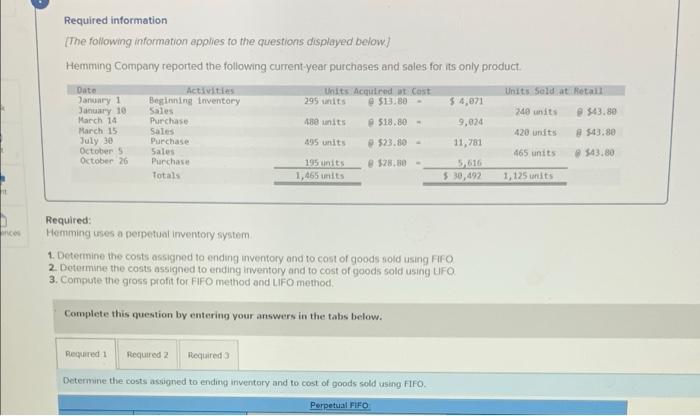

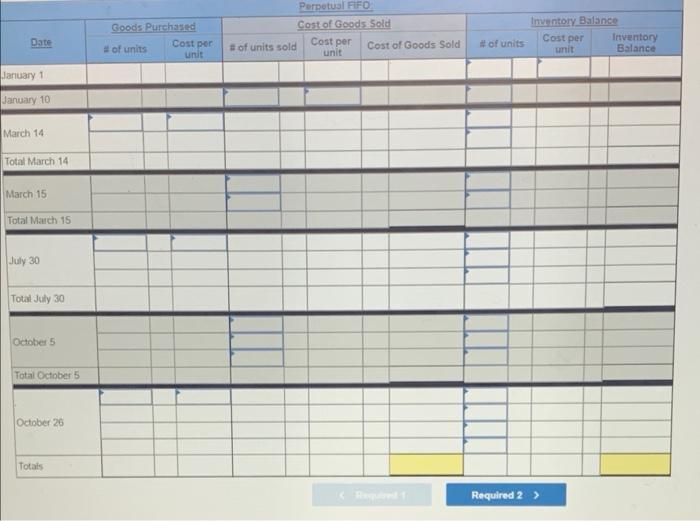

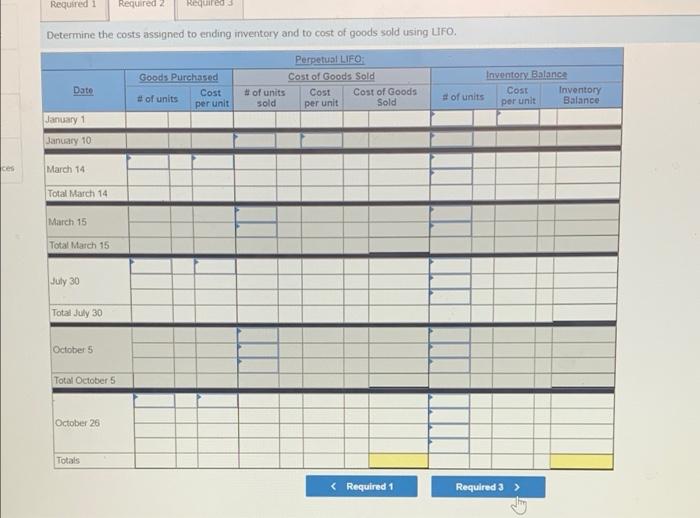

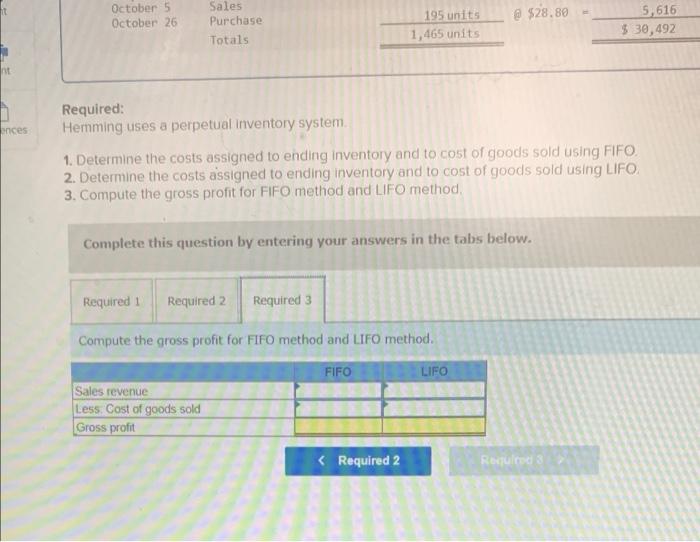

Required information The following information applies to the questions displayed below) Hemming Company reported the following current-year purchases and sales for its only product. Dato Activities Units Acquired at Cost Units Solat Betan January 1 Beginning Inventory 295 units @ $13.80- $ 4,071 January 10 Sales 240 units 343.80 March 14 Purchase 188 units 518.80 - 9,024 March 15 Sales 420 units 8543.80 July 30 Purchase 495 units 523.80- 11,781 October 5 Sales 465 units $43.80 October 26 Purchase 195 units $28.00 - 5616 Totals 1,465 units 530,492 1,125 units Required: Hemming uses a perpetual inventory system 1. Determine the costs assigned to ending inventory and to cost of goods sold using FIFO 2. Determine the costs assigned to ending inventory and to cost of goods sold using UFO 3. Compute the gross profit for FIFO method and LIFO method, Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required Determine the costs assigned to ending inventory and to cost of goods sold using FIFO Perpetual FIFO Perpetual FIFO Cost of Goods Sold Goods Purchased Cost per # of units unit Inventory Balance Cost per Inventory unit Balance Date of units sold Cost per unit Cost of Goods Sold of units January 1 January 10 March 14 Total March 14 March 15 Total March 15 July 30 Total July 30 October 5 Total October 5 October 25 Totals Required 2 > Required i Required 2 Required Determine the costs assigned to ending inventory and to cost of goods sold using LIFO. Goods Purchased # of units Cost per unit Date Perpetual LIFO Cost of Goods Sold # of units Cost Cost of Goods sold per unit Sold Inventory Balance of units COSE Inventory per unit Balance January 1 January 10 ces March 14 Total March 14 March 15 Total March 15 July 30 Total July 30 October 5 Total October 5 October 26 Totals October 5 October 26 @ $28.80 Sales Purchase Totals 195 units 1,465 units 5,616 $ 30,492 ences Required: Hemming uses a perpetual inventory system 1. Determine the costs assigned to ending inventory and to cost of goods sold using FIFO, 2. Determine the costs assigned to ending inventory and to cost of goods sold using LIFO 3. Compute the gross profit for FIFO method and LIFO method, Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Compute the gross profit for FIFO method and LIFO method. FIFO LIFO Sales revenue Less Cost of goods sold Gross profit

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts