Question: need help on both Letter C and D do letter D only them Financial Accounting Instructor Turck Prepare your solutions neatly on your own paper.

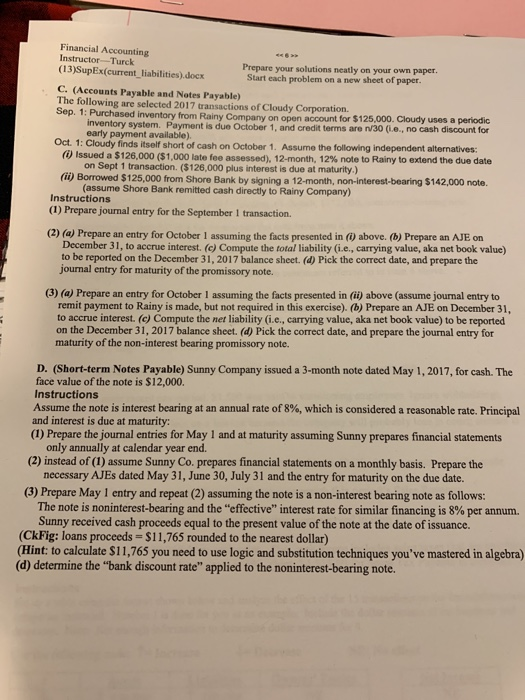

Financial Accounting Instructor Turck Prepare your solutions neatly on your own paper. (13)SupEx(current liabilities) docx Start each problem on a new sheet of paper. C. (Accounts Payable and Notes Payable) The following are selected 2017 transactions of Cloudy Corporation. Sep. 1: Purchased Inventory from Rainy Company on open account for $125,000. Cloudy uses a periodic Inventory system. Payment is due October 1, and credit terms are i30 (.., no cash discount for early payment available) Oct. 1: Cloudy finds itself short of cash on October 1. Assume the following independent alternatives: (i) issued a $126,000 ($1.000 late fee assessed). 12-month, 12% note to Rainy to extend the due date on Sept 1 transaction ($126,000 plus interest is due at maturity) (1) Borrowed $125,000 from Shore Bank by signing a 12 month, non-interest-bearing $142,000 note. (assume Shore Bank remitted cash directly to Rainy Company) Instructions (1) Prepare journal entry for the September I transaction. (2) (a) Prepare an entry for October I assuming the facts presented in (above. (b) Prepare an AJE on December 31, to accrue interest. (c) Compute the total liability (i.e., carrying value, aka net book value) to be reported on the December 31, 2017 balance sheet. (d) Pick the correct date, and prepare the journal entry for maturity of the promissory note. (3) () Prepare an entry for October I assuming the facts presented in (1) above (assume journal entry to remit payment to Rainy is made, but not required in this exercise). (b) Prepare an AJE on December 31, to accrue interest. (C) Compute the ner liability (i.e., carrying value, aka net book value) to be reported on the December 31, 2017 balance sheet. (d) Pick the correct date, and prepare the journal entry for maturity of the non-interest bearing promissory note. D. (Short-term Notes Payable) Sunny Company issued a 3-month note dated May 1, 2017, for cash. The face value of the note is $12,000. Instructions Assume the note is interest bearing at an annual rate of 8%, which is considered a reasonable rate. Principal and interest is due at maturity: (1) Prepare the journal entries for May 1 and at maturity assuming Sunny prepares financial statements only annually at calendar year end. (2) instead of (1) assume Sunny Co, prepares financial statements on a monthly basis. Prepare the necessary AJEs dated May 31, June 30, July 31 and the entry for maturity on the due date. (3) Prepare May 1 entry and repeat (2) assuming the note is a non-interest bearing note as follows: The note is noninterest-bearing and the "effective" interest rate for similar financing is 8% per annum. Sunny received cash proceeds equal to the present value of the note at the date of issuance. (CkFig: loans proceeds - $11,765 rounded to the nearest dollar) (Hint: to calculate $11,765 you need to use logic and substitution techniques you've mastered in algebra) (d) determine the "bank discount rate" applied to the noninterest-bearing

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts