Question: need help on both please A stock has a beta of 1.25 and an expected retum of 15 percent. A risk-free asset currently eams 3.2

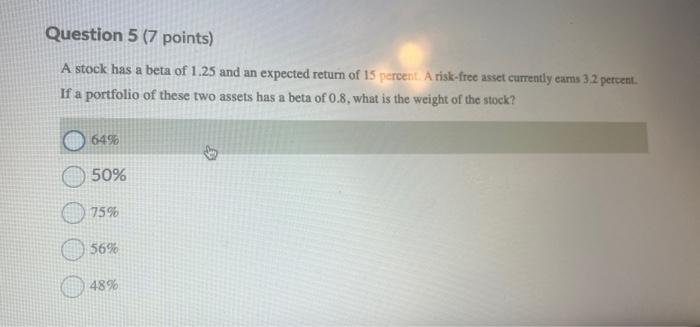

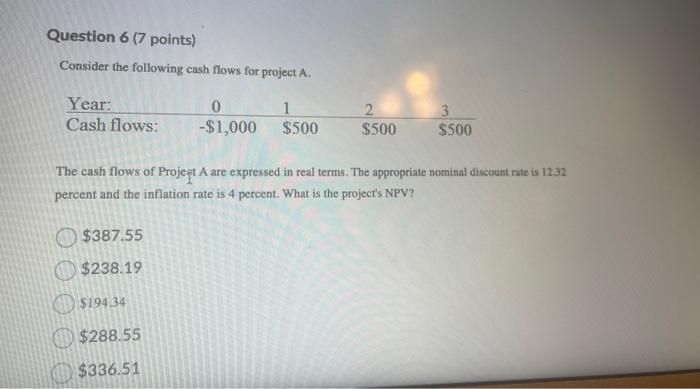

A stock has a beta of 1.25 and an expected retum of 15 percent. A risk-free asset currently eams 3.2 pervent. If a portfolio of these two assets has a beta of 0.8, what is the weight of the stock? \begin{tabular}{|l|l|l|} 64% \\ 50% \\ 75% \\ 56% \\ 48% \end{tabular} Consider the following cash flows for project A. The cash flows of Projept A are expressed in real terms. The appropriate nominal discount nate is 12.32 percent and the inflation rate is 4 percent. What is the project's NPV? $387.55$238.19$194.34$288.55$336.51

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts