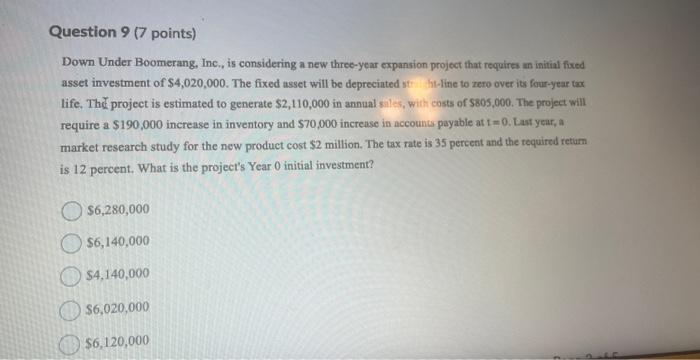

Question: need help on both please Down Under Boomerang, Inc, is considering a new three-year expansion project that requires an initial fixed asset investment of $4,020,000.

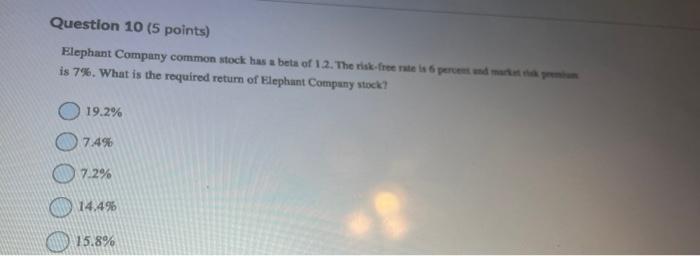

Down Under Boomerang, Inc, is considering a new three-year expansion project that requires an initial fixed asset investment of $4,020,000. The fixed asset will be depreciated st . he-line to zero over its four-year tax life. Th project is estimated to generate $2,110,000 in annual siles, with costs of $805,000. The project will require a $190,000 increase in inventory and $70,000 increase in accounts payable at t=0. Last year, a market research study for the new product cost $2 million. The tax rate is 35 percent and the required return is 12 percent. What is the project's Year 0 initial investment? $6,280,000 $6,140,000$4,140,000 $6,020,000 $6,120,000 Blephant Company common stock has a beta of 12 . The risk-free rate is 6 perveat ald martit tha prowan is 7\%. What is the required retum of klephant Company stock? 19.2% 7+496 14.495 15.8%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts