Question: need help on both please Question 7 ( 10 points) RoIting Corporation is estimating its WACC. It has 5,000 bonds outstending with a face value

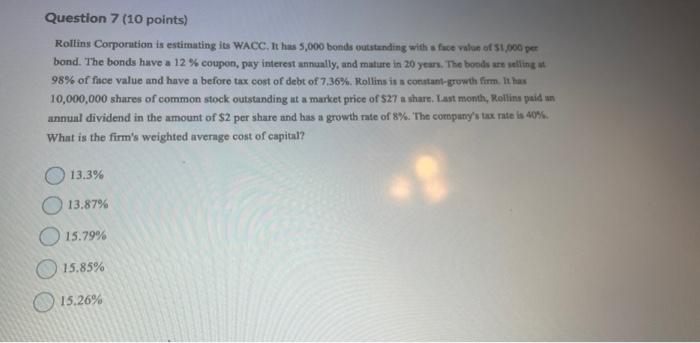

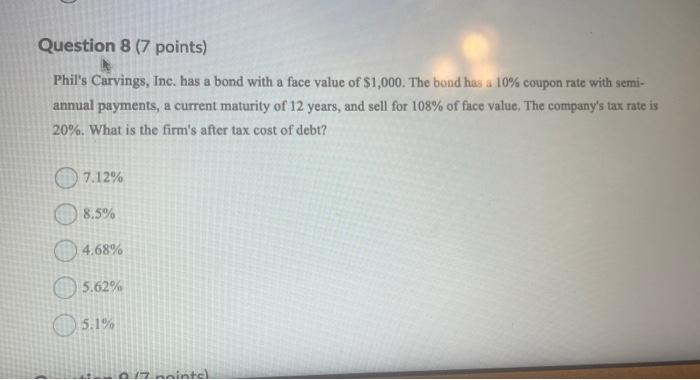

Question 7 ( 10 points) RoIting Corporation is estimating its WACC. It has 5,000 bonds outstending with a face value of 51,000 per bond. The bonds have a 12% coupon, pay interest annually, and mature in 20 years. The boteds are selite se st 98% of face value and have a before tax cost of debt of 7.36%. Follins is a conatant-growth firm. It has 10,000,000 shares of common stock outstanding at a market price of $27 a share. Iast month, Rotlins paid un annual dividend in the amount of $2 per share and bas a growth nate of 8%. The corrpany's tax nate is 40%6. What is the firm's weighted average cost of capital? 13.3% 13.87% 15.79% 15.85% 15,26% Question 8 (7 points) Phil's Carvings, Inc. has a bond with a face value of $1,000. The bond has a 10% coupon rate with semiannual payments, a current maturity of 12 years, and sell for 108% of face value. The company's tax rate is 20%. What is the firm's after tax cost of debt? 7.12% 8.5% 4.68% 5.62% 5.1%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts