Question: need help on both Question 11 (6 points) The company is expected to pay a year-end dividend of 51.4 per share, which is expected to

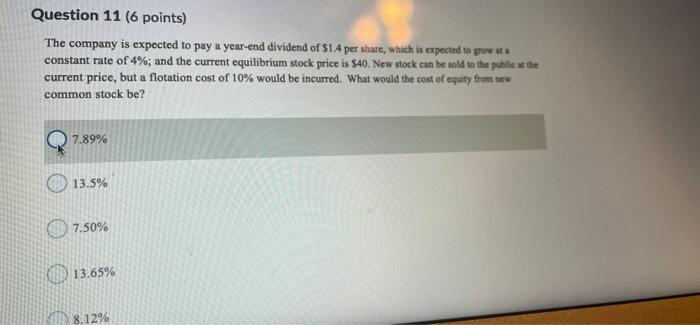

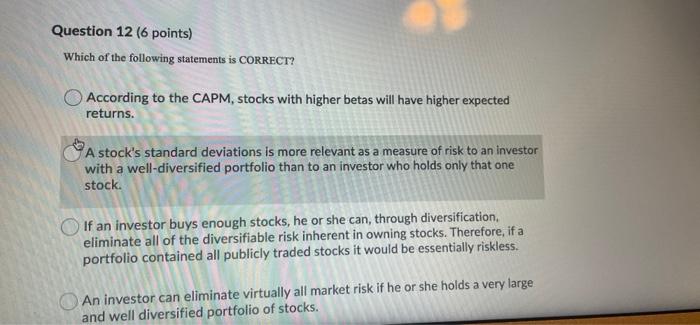

Question 11 (6 points) The company is expected to pay a year-end dividend of 51.4 per share, which is expected to grow at constant rate of 4%; and the current equilibrium stock price is $40. New stock can be sold to the public at the current price, but a flotation cost of 10% would be incurred. What would the cost of equity from new common stock be? 7.89% 13.5% 7.50% 13.65% 8.12% Question 12 (6 points) Which of the following statements is CORRECT? According to the CAPM, stocks with higher betas will have higher expected returns. A stock's standard deviations is more relevant as a measure of risk to an investor with a well-diversified portfolio than to an investor who holds only that one stock. If an investor buys enough stocks, he or she can, through diversification, eliminate all of the diversifiable risk inherent in owning stocks. Therefore, if a portfolio contained all publicly traded stocks it would be essentially riskless. An investor can eliminate virtually all market risk if he or she holds a very large and well diversified portfolio of stocks

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts