Question: need help on both! The dividend Chow Inc. is expected to pay at the end of next year is $2.93. It has grown 1.2% per

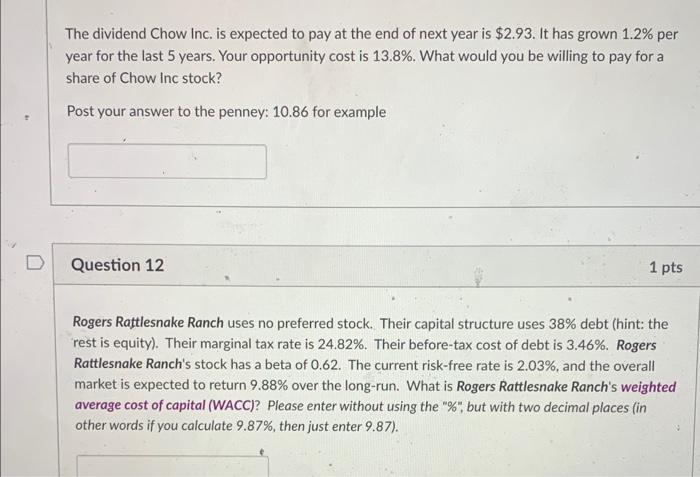

The dividend Chow Inc. is expected to pay at the end of next year is $2.93. It has grown 1.2% per year for the last 5 years. Your opportunity cost is 13.8%. What would you be willing to pay for a share of Chow Inc stock? Post your answer to the penney: 10.86 for example Question 12 1 pts Rogers Rattlesnake Ranch uses no preferred stock. Their capital structure uses 38% debt (hint: the rest is equity). Their marginal tax rate is 24.82%. Their before-tax cost of debt is 3.46%. Rogers Rattlesnake Ranch's stock has a beta of 0.62. The current risk-free rate is 2.03%, and the overall market is expected to return 9.88% over the long-run. What is Rogers Rattlesnake Ranch's weighted average cost of capital (WACC)? Please enter without using the "\%", but with two decimal places (in other words if you calculate 9.87%, then just enter 9.87 )

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts