Question: Need help on E1-8 E1-9. Thank you!! a Analyse transactions and compute ne income E1-8 An analysis of the transactions made by Arthur Cooper &

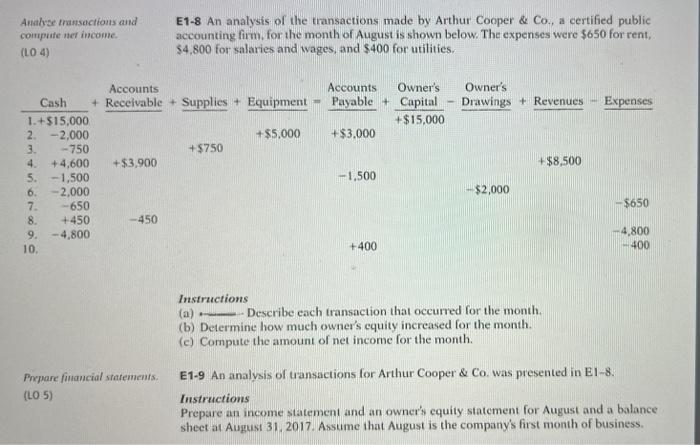

a Analyse transactions and compute ne income E1-8 An analysis of the transactions made by Arthur Cooper & Co., a certified public accounting firm. for the month of August is shown below. The expenses were $650 for rent $4,800 for salaries and wages, and $400 for utilities. (L04) Owner's Drawings + Revenues Expenses Accounts Owner's Payable + Capital +$15,000 +$3,000 Accounts Cash + Receivable + Supplies - Equipment 1.+$15,000 2 -2,000 + $5,000 3. -750 +$750 4. +4,600 +$3,900 5.-1,500 6. -2,000 7. -650 8. +450 -450 9. - 4.800 10. $8,500 - 1,500 $2,000 -$650 4,800 -400 +400 Instructions (a) Describe each transaction that occurred for the month (b) Determine how much owner's equity increased for the month (c) Compute the amount of net income for the month. Prepare financial statements (LO 5) E1-9 An analysis of transactions for Arthur Cooper & Co. was presented in B1-8. Instructions Prepare an income statement and an owner's equity statement for August and a balance sheet at August 31, 2017. Assume that August is the company's first month of business

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts