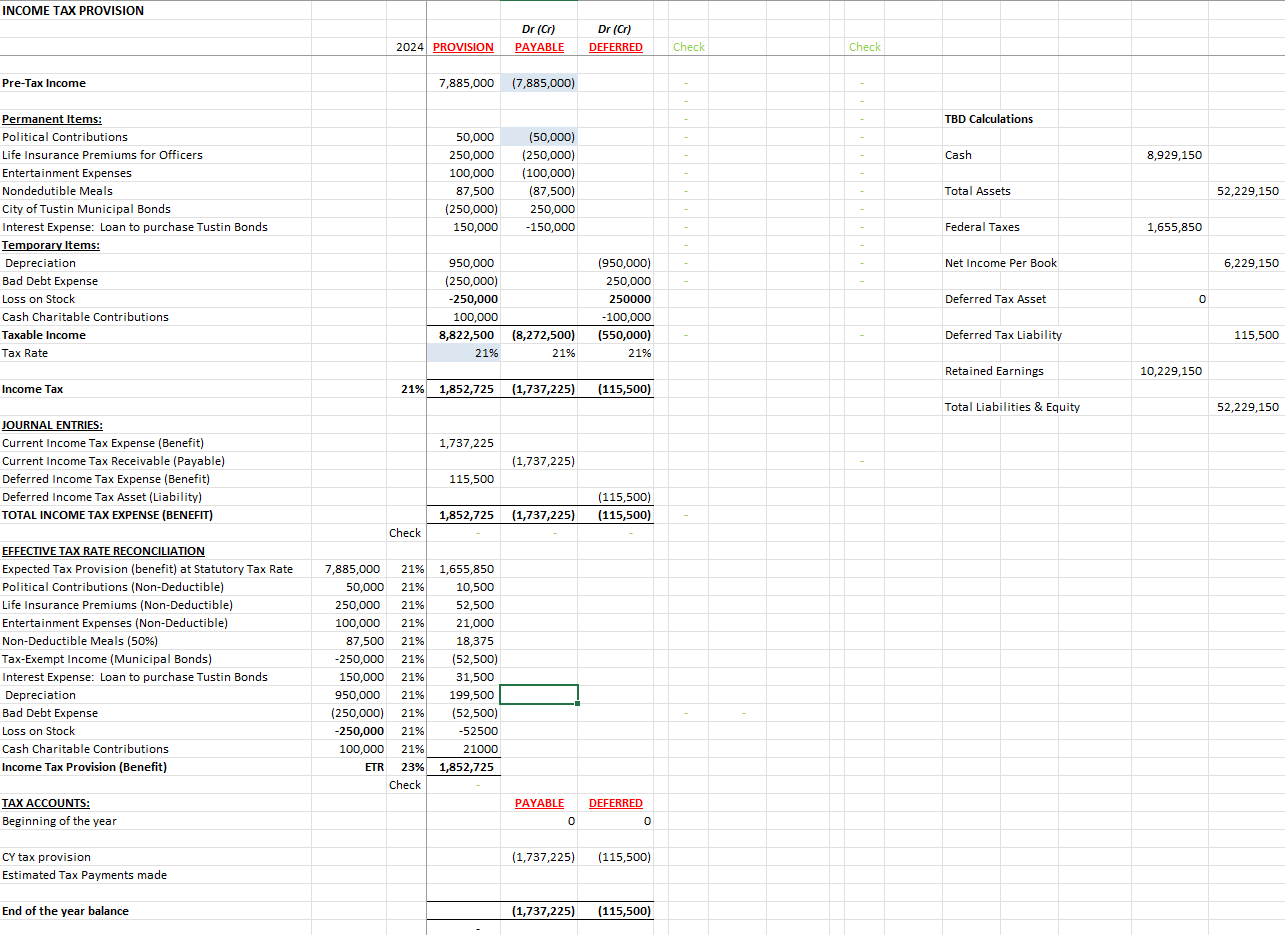

Question: Need Help on making a tax provision for my practice set. Provided is what i have in my tax provision on an excel, the financial

Need Help on making a tax provision for my practice set. Provided is what i have in my tax provision on an excel, the financial statement used for the tax provision. please help with tax provision Im confused on where the numbers Pos and Neg lay for the temporary items and why when I calculate Current Tax Expense, Temporary Differences, Total Tax Expense,Effective Tax Rate the numbers don't line up or make sense.

Cash TBD Accounts Receivable Bad Debt Allowance Inventories Stock Investment Mini Bonds CDs Equipment: Other Equipment Accumulated Depreciation Defered Tax Asset TBD Total Assets TBD Accounts Payable Federal Taxes Payable Deferred Tax Liability TBD Line Of Credit Capital Stock Retained Earnings TBD Total Liabilities and Equity TBD

Includes borrowing for Tax Exempt Bonds

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock