Question: Need Help on part A & B Pra forma balance sheet Peabody & Peabody has 2019 sales of $10.5 million. It wishes to anal Z

Need Help on part A & B

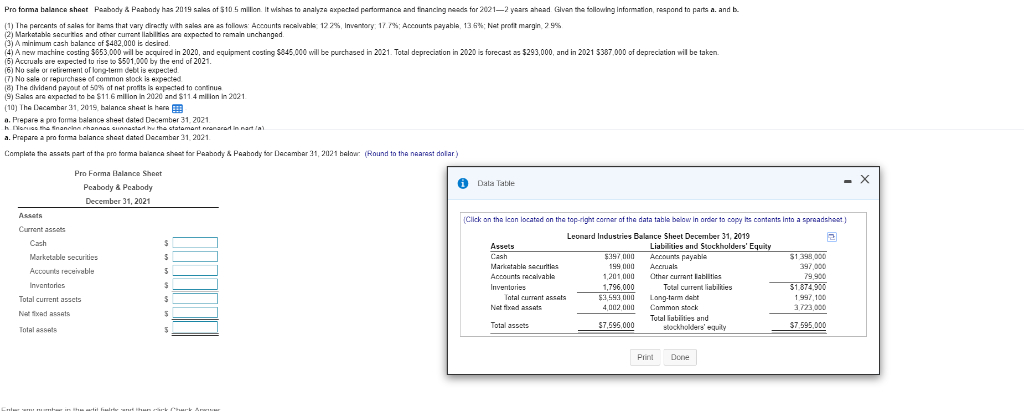

Pra forma balance sheet Peabody & Peabody has 2019 sales of $10.5 million. It wishes to anal Z Axpected performance and tnancing needs for 2021-2 years ahead Glven the following information respond to parts a. and b 11) The percents of Sales for tem that vary directly with sales are as follows Accounts receivable 12 % Inventory 177% Accounts payabi, 13 6% Net profit margin 299 2) Marketable securities and other current liables and expected to remain unchanged (3) A minimum cash balance of $482,000 is desired. (4) A new machine costing 3653,000 will be acquired in 2020, and equipment costing S845.000 will be purchased in 2021. Total depreciation in 2020 is forecast as $293,000, and in 2021 5387,000 of depreciation wil be taken. 161 Accruals are expected to rise to $501.000 by the end of 2021. 16) No see or retirement of long-lem debt is expected No sale or repurchase of common stock is expected 8) The MidAnd Payout of 50% of nat profits is spected to continua 19 Sales are axpected to be $116 milion in 2020 and $11.4 milion in 2021 10) The December 31 2019 balance sheet is here 310 a. Prepare a profoma balance sheet dated December 31, 2021 a. Prepare a potoma balance sheet dated December 31 2021 Completa tha assets part of the preforma balance sheet for Peabody & Peabody for December 31, 2021 halow (Round to the nearest dollar Pro Forma Balance Sheet Peabody & Peabody December 31, 2021 i Dala Table Assets Click on the can located on the top right corner of the data tabia balow in order to copy its contents into a spreadsheet Current assets 5139000 397 000 Cash Marketable securities Accounts receivable Inventories Total current assets Net ad a ts 79 900 Leonard Industries Balance Sheet December 31, 2019 Assets Liabilities and Stuckholders' Equity $397 000 Accounts payable Marketable securities 199 000 Aconials Accounts recalvable 1 201 000 Other current liabilities Inventories 1.796.000 Total current liabilities Total current Assets $3,593 000 Long-tamm debt Net xed assets 4002 000 Common stock Total Cablities and Total assets $7.595.000 stockholders' equily $1 874.900 1997.100 3723 000 $7 595.000 Total Print Done

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts