Question: Need help on part B. Option B is incorrect. a. The tax law refers to gross income, yet the term gross income is not found

Need help on part B.

Option B is incorrect.

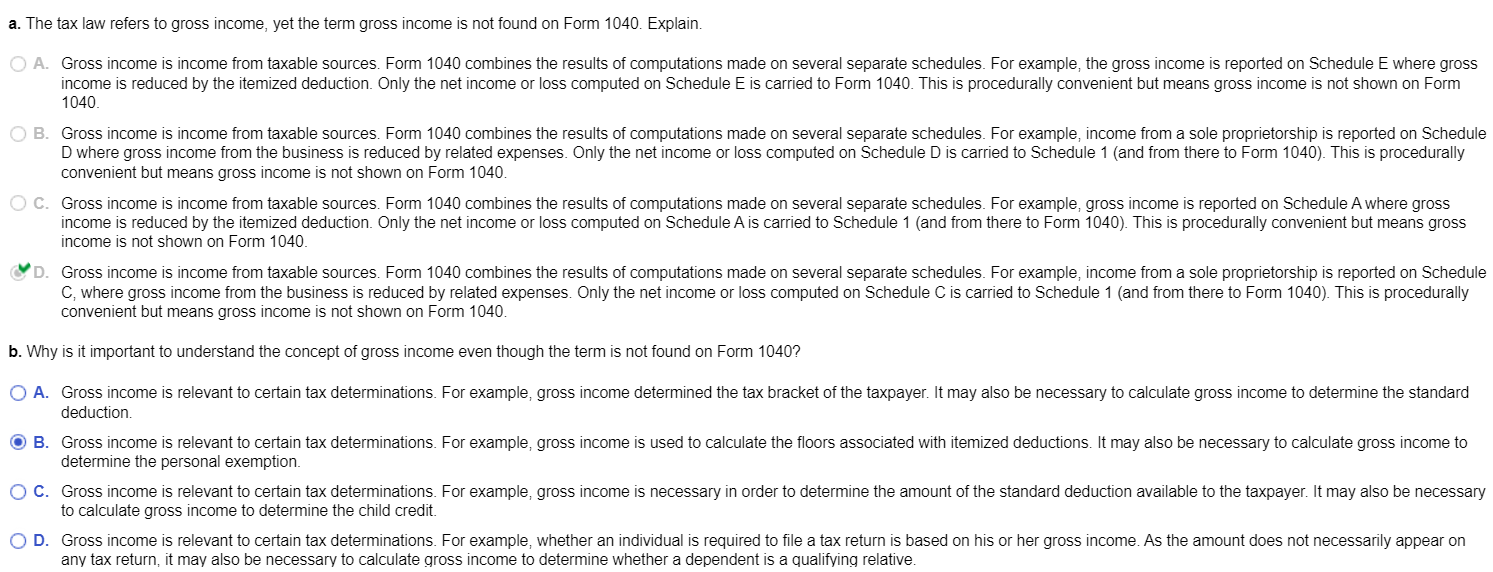

a. The tax law refers to gross income, yet the term gross income is not found on Form 1040. Explain. O A. Gross income is income from taxable sources. Form 1040 combines the results of computations made on several separate schedules. For example, the gross income is reported on Schedule E where gross income is reduced by the itemized deduction. Only the net income or loss computed on Schedule E is carried to Form 1040. This is procedurally convenient but means gross income is not shown on Form 1040 O B. Gross income is income from taxable sources. Form 1040 combines the results of computations made on several separate schedules. For example, income from a sole proprietorship is reported on Schedule D where gross income from the business is reduced by related expenses. Only the net income or loss computed on Schedule D is carried to Schedule 1 (and from there to Form 1040). This is procedurally convenient but means gross income is not shown on Form 1040. O C. Gross income is income from taxable sources. Form 1040 combines the results of computations made on several separate schedules. For example, gross income is reported on Schedule A where gross income is reduced by the itemized deduction. Only the net income or loss computed on Schedule A is carried to Schedule 1 (and from there to Form 1040). This is procedurally convenient but means gross income is not shown on Form 1040 D. Gross income is income from taxable sources. Form 1040 combines the results of computations made on several separate schedules. For example, income from a sole proprietorship is reported on Schedule C, where gross income from the business is reduced by related expenses. Only the net income or loss computed on Schedule Cis carried to Schedule 1 (and from there to Form 1040). This is procedurally convenient but means gross income is not shown on Form 1040. b. Why is it important to understand the concept of gross income even though the term is not found on Form 1040? O A. Gross income is relevant to certain tax determinations. For example, gross income determined the tax bracket of the taxpayer. It may also be necessary to calculate gross income to determine the standard deduction. O B. Gross income is relevant to certain tax determinations. For example, gross income is used to calculate the floors associated with itemized deductions. It may also be necessary to calculate gross income to determine the personal exemption. C. Gross income is relevant to certain tax determinations. For example, gross income is necessary in order to determine the amount of the standard deduction available to the taxpayer. It may also be necessary to calculate gross income to determine the child credit. D. Gross income is relevant to certain tax determinations. For example, whether an individual is required to file a tax return is based on his or her gross income. As the amount does not necessarily appear on any tax return, it may also be necessary to calculate gross income to determine whether a dependent is a qualifying relative

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts