Question: need help on part B please! Scenario B: Parker Limited reported a total net income of $574 million before taxes. During the year, Parker Limited

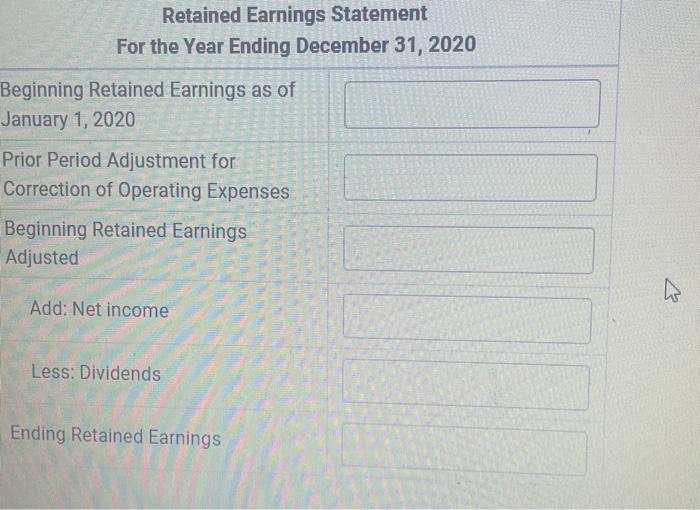

Scenario B: Parker Limited reported a total net income of $574 million before taxes. During the year, Parker Limited committed to dispose of its retall repair shops. The retail repair shops are a component of its business and the disposal represents a strategic shift in the company's operations. The repair shops had a carrying value of $70 million and were sold at a net selling price of $63 million. The retail repair shops reported $105 million in pretax operating losses for the year, from the beginning of the year and up to the date of sale Retained Earnings Statement For the Year Ending December 31, 2020 Beginning Retained Earnings as of January 1,2020 Prior Period Adjustment for Correction of Operating Expenses Beginning Retained Earnings Adjusted Add: Net income Less: Dividends Ending Retained Earnings Scenario B: Parker Limited reported a total net income of $574 million before taxes. During the year, Parker Limited committed to dispose of its retall repair shops. The retail repair shops are a component of its business and the disposal represents a strategic shift in the company's operations. The repair shops had a carrying value of $70 million and were sold at a net selling price of $63 million. The retail repair shops reported $105 million in pretax operating losses for the year, from the beginning of the year and up to the date of sale Retained Earnings Statement For the Year Ending December 31, 2020 Beginning Retained Earnings as of January 1,2020 Prior Period Adjustment for Correction of Operating Expenses Beginning Retained Earnings Adjusted Add: Net income Less: Dividends Ending Retained Earnings

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts