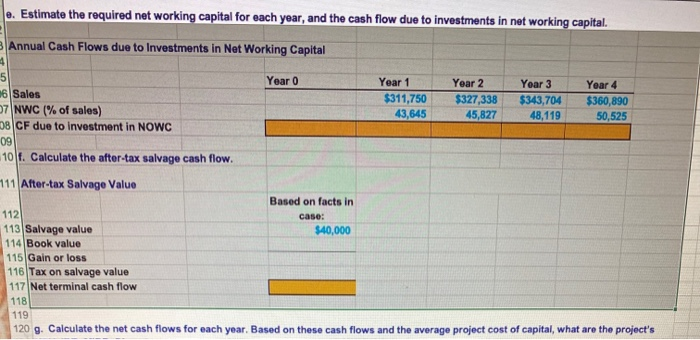

Question: need help on part E. I have also posted inputs. also could use help on part f! . Estimate the required net working capital for

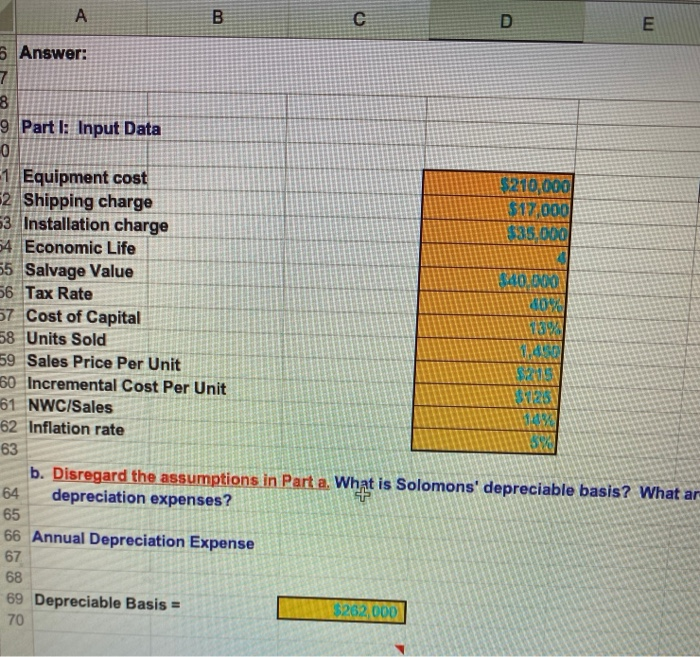

. Estimate the required net working capital for each year, and the cash flow due to investments in net working capital. Annual Cash Flows due to Investments in Net Working Capital 4 5 Year 0 Year 1 $311,750 43,645 Year 2 $327,338 45,827 Year 3 $343,704 48,119 Year 4 $360,890 50,525 16 Sales 07 NWC (% of sales) 08CF due to investment in NOWC 09 10 f. Calculate the after-tax salvage cash flow. 11 After-tax Salvage Value Based on facts in 1121 case: 113 Salvage value $40,000 114 Book value 115 Gain or loss 116 Tax on salvage value 117 Net terminal cash flow 118 119 120 g. Calculate the net cash flows for each year. Based on these cash flows and the average project cost of capital, what are the project's B E 6 Answer: 7 9 Part I: Input Data 0 1 Equipment cost $210,000 2 Shipping charge $120001 53 Installation charge $35.000 54 Economic Life 55 Salvage Value 320.000 56 Tax Rate 57 Cost of Capital 139 58 Units Sold 59 Sales Price Per Unit 2013 60 Incremental Cost Per Unit 25 61 NWC/Sales 62 Inflation rate 63 b. Disregard the assumptions in Part a. What is Solomons' depreciable basis? What ar 64 depreciation expenses? + 65 66 Annual Depreciation Expense 67 68 69 Depreciable Basis = 70 $262 000 . Estimate the required net working capital for each year, and the cash flow due to investments in net working capital. Annual Cash Flows due to Investments in Net Working Capital 4 5 Year 0 Year 1 $311,750 43,645 Year 2 $327,338 45,827 Year 3 $343,704 48,119 Year 4 $360,890 50,525 16 Sales 07 NWC (% of sales) 08CF due to investment in NOWC 09 10 f. Calculate the after-tax salvage cash flow. 11 After-tax Salvage Value Based on facts in 1121 case: 113 Salvage value $40,000 114 Book value 115 Gain or loss 116 Tax on salvage value 117 Net terminal cash flow 118 119 120 g. Calculate the net cash flows for each year. Based on these cash flows and the average project cost of capital, what are the project's B E 6 Answer: 7 9 Part I: Input Data 0 1 Equipment cost $210,000 2 Shipping charge $120001 53 Installation charge $35.000 54 Economic Life 55 Salvage Value 320.000 56 Tax Rate 57 Cost of Capital 139 58 Units Sold 59 Sales Price Per Unit 2013 60 Incremental Cost Per Unit 25 61 NWC/Sales 62 Inflation rate 63 b. Disregard the assumptions in Part a. What is Solomons' depreciable basis? What ar 64 depreciation expenses? + 65 66 Annual Depreciation Expense 67 68 69 Depreciable Basis = 70 $262 000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts