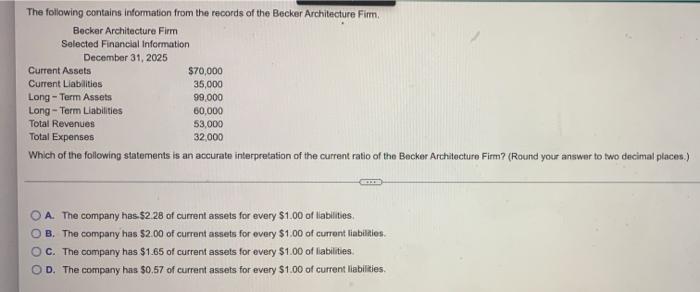

Question: need help on practice problems! The following contains information from the records of the Becker Architecture Firm. Becker Architecture Firm Selected Financial Information December 31,

The following contains information from the records of the Becker Architecture Firm. Becker Architecture Firm Selected Financial Information December 31, 2025 Current Assets $70,000 Current Liabilities 35,000 Long-Term Assets 99,000 Long-Term Liabilities 60,000 Total Revenues 53,000 Total Expenses 32,000 Which of the following statements is an accurate interpretation of the current ratio of the Becker Architecture Firm? (Round your answer to two decimal places.) A. The company has $2.28 of current assets for every $1.00 of liabilities. OB. The company has $2.00 of current assets for every $1.00 of current liabilities. OC. The company has $1.65 of current assets for every $1.00 of liabilities. D. The company has $0.57 of current assets for every $1.00 of current liabilities

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts