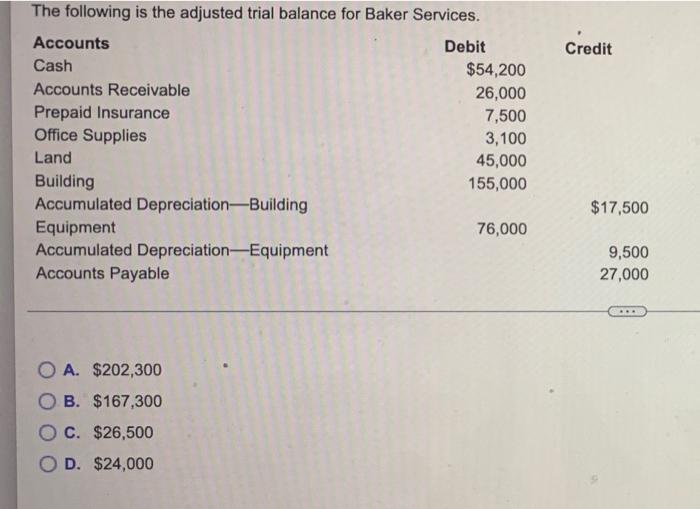

Question: need help on practice problems! The following is the adjusted trial balance for Baker Services. Accounts Cash Accounts Receivable Prepaid Insurance Office Supplies Land Building

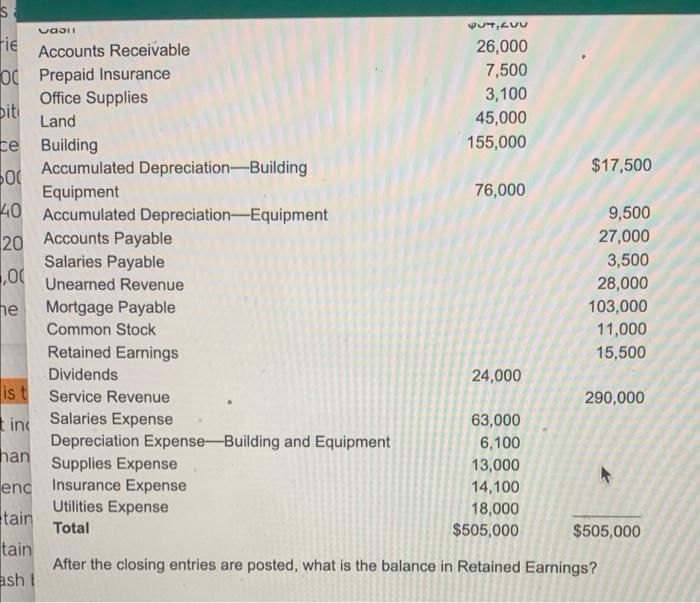

The following is the adjusted trial balance for Baker Services. Accounts Cash Accounts Receivable Prepaid Insurance Office Supplies Land Building Accumulated Depreciation-Building Equipment Accumulated Depreciation-Equipment Accounts Payable OA. $202,300 B. $167,300 O C. $26,500 D. $24,000 Debit $54,200 26,000 7,500 3,100 45,000 155,000 76,000 Credit $17,500 9,500 27,000 S PUT, 200 Uadil rie 26,000 Accounts Receivable 00 Prepaid Insurance 7,500 Office Supplies 3,100 Dit Land 45,000 ce Building 155,000 Accumulated Depreciation-Building $17,500 500 Equipment 76,000 40 Accumulated Depreciation Equipment 9,500 20 Accounts Payable 27,000 Salaries Payable 3,500 ,00 Unearned Revenue 28,000 e 103,000 Mortgage Payable Common Stock 11,000 Retained Earnings 15,500 Dividends 24,000 ist Service Revenue 290,000 tinc Salaries Expense 63,000 Depreciation Expense-Building and Equipment 6,100 han Supplies Expense 13,000 enc Insurance Expense 14,100 Utilities Expense 18,000 tain Total $505,000 $505,000 tain After the closing entries are posted, what is the balance in Retained Earnings? ash f

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts