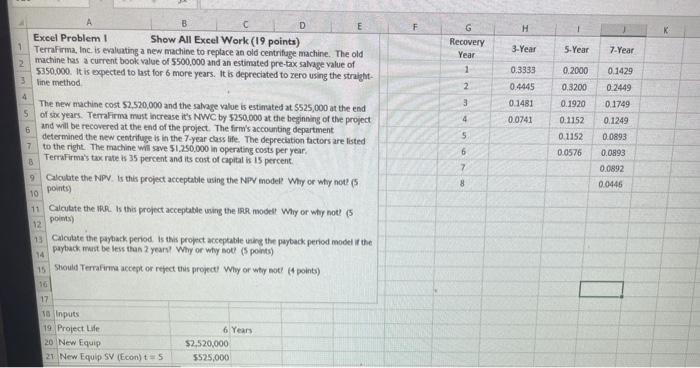

Question: need help on problem F H 3-Year 5-Year 7-Year G Recovery Year 1 2 0 2000 0.1429 0.3200 0.3333 0.4445 0.1481 0.0741 3 1920 4

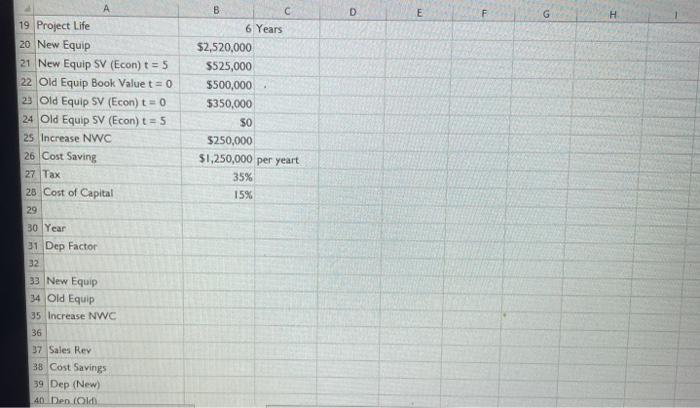

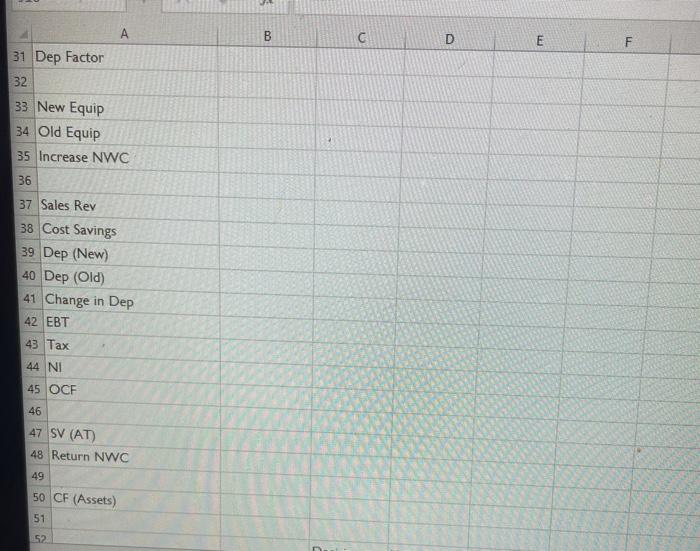

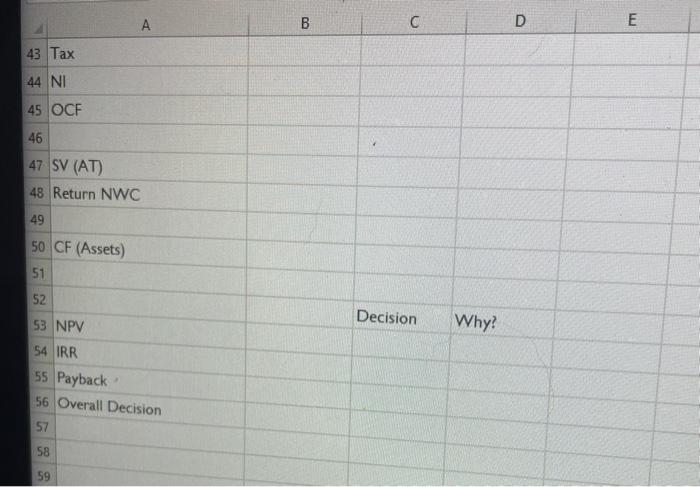

F H 3-Year 5-Year 7-Year G Recovery Year 1 2 0 2000 0.1429 0.3200 0.3333 0.4445 0.1481 0.0741 3 1920 4 5 A B D E Excel Problem! Show All Excel Work (19 points) 1 TerraFirma, Inc is evaluating a new machine to replace an old centrifuge machine. The old 2 machine has a current book value of $500,000 and an estimated pre-tax salvage value of 5350.000. It is expected to last for 6 more years. It is depreciated to zero using the straight- 3 line method The new machine cost 52,520,000 and the salvage value is estimated at 5525,000 at the end 5 of sox years. Terrafirma must increase it's NWC by 5250.000 at the beginning of the project 6 and will be recovered at the end of the project. The firm's accounting department determined the new centrifuge is in the 7-year class life. The depreciation factors are listed 7 to the right. The machine will save 51.250.000 in operating costs per year. B Terrafirma's tax rate is 35 percent and its cost of capital is 15 percent 9 Calculate the NPV. Is this project acceptable using the NPV model? Why or why not? 10 points) 11 Calculate the 1RR. Is this project acceptable using the IRR modelt Why or why not! (5 12 points) 13 Calculate the payback period. Is this project acceptable using the payback period model the paytack must be less than 2 years! Why or why not! (5 points) 14 15 Should Terrafirma accept or reject this project! Why or wty not! (4 points) 0:1152 0.1152 0.0576 0.2449 0.1749 0.1249 0.0893 0.0893 0.0892 0.0446 6 7 8 10 17 18 Inputs 19 Project Life 20 New Equip 21. New Equip SV (Econ) 5 6 Years $2.520,000 5525,000 D E F G H B 6 Years $2,520,000 $525,000 $500,000 $350,000 SO $250,000 $1,250,000 per yeart 35% 15% 19 Project Life 20 New Equip 21 New Equip SV (Econ) t = 5 22 Old Equip Book Value t = 0 23 Old Equip SV (Econ) t = 0 24 Old Equip SV (Econ) t = 5 25 Increase NWO 26 Cost Saving 27 Tax 28 Cost of Capital 29 30 Year 31 Dep Factor 32 33 New Equip 34 Old Equip 35 Increase NWC 36 37 Sales Rev 38 Cost Savings 39 Dep (New) An Den (Old A B D E F 31 Dep Factor 32 33 New Equip 34 Old Equip 35 Increase NWC 36 37 Sales Rey 38 Cost Savings 39 Dep (New) 40 Dep (Old) 41 Change in Dep 42 EBT 43 Tax 44 NI 45 OCF 46 47 SV (AT) 48 Return NWC 49 50 CF (Assets) 51 52 A B D E 43 Tax 44 NI 45 OCF 46 47 SV (AT) 48 Return NWC 49 50 CF (Assets) 51 Decision Why? 52 53 NPV 54 IRR 55 Payback 56 Overall Decision 57 58 59

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts