Question: Need help on question 1 please! Part B: SHORT ANSWER QUE QUESTION I (8 marks) You are an investment analyst working in the finance department

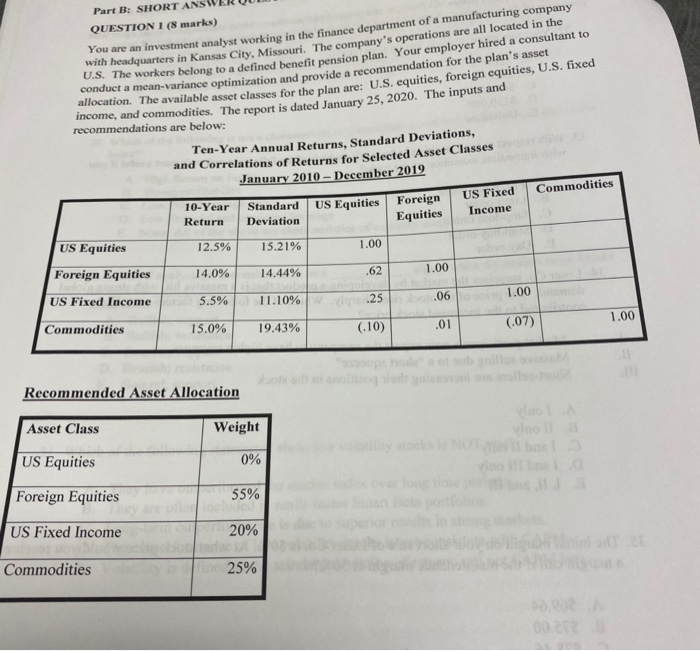

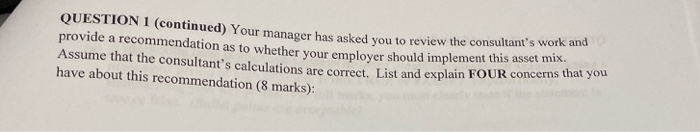

Part B: SHORT ANSWER QUE QUESTION I (8 marks) You are an investment analyst working in the finance department of a manufacturing company with headquarters in Kansas City, Missouri. The company's operations are all located in the belong to a defined benefit pension plan. Your employer hired a consultant to conduct a mean-variance optimization and provide a recommendation for the plan s asset allocation. The available asset classes for the plan are: U.S. equities, foreign equities, U.S. fixed income, and commodities. The report is dated January 25, 2020. The inputs and recommendations are below: Ten-Year Annual Returns, Standard Deviations, and Correlations of Returns for Selected Asset Classes January 2010 December 2019 Commodities US Equities 10-Year Return Standard Deviation US Fixed Income Equities US Equities 12.5% 15.21% 1.00 Foreign Equities 14.0% 14.44% 1.00 .62 US Fixed Income 5.5% 1.00 11.10% .25 .06 Commodities 15.0% 1.00 19.43% (.10) (.07) .01 Recommended Asset Allocation Asset Class Weight US Equities 0% Foreign Equities 55% US Fixed Income 20% Commodities 25% QUESTION 1 (continued) Your manager has asked you to review the cons provide a recommendation as to whether your employer should implemen Assume that the consultant's calculations are correct. List and explam tant s calculations are correct. List and explain FOUR concerns that you have about this recommendation (8 marks): has asked you to review the consultant's work and your employer should implement this asset mix

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts