Question: need help on question 6 & 7 !! D is not the answer to either one. Use the following information to answer the next 5

need help on question 6 & 7 !! D is not the answer to either one.

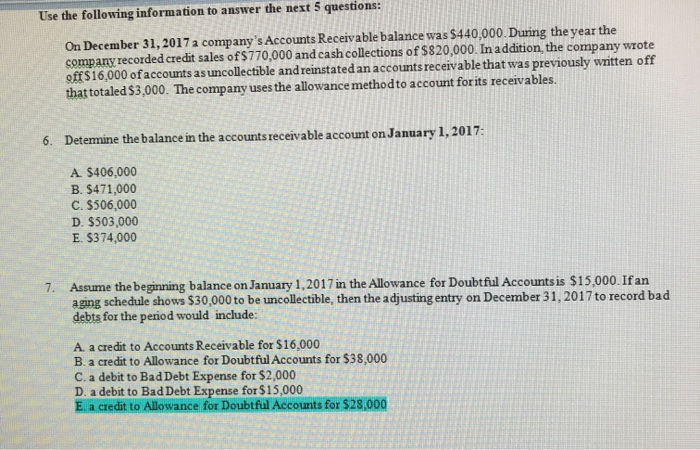

need help on question 6 & 7 !! D is not the answer to either one.Use the following information to answer the next 5 questions: On December 31, 2017 a company's Accounts Receivable balance was $440,000. During the year the company recorded credit sales of$770,000 and cash collections of $820,000. In addition, the company wrote off$16,000 ofaccounts as uncollectible and reinstated an accounts receivable that was previously written off that totaled $3,000. The company uses the allowance methodto account for its receivables. Detemine the balance in the accounts receivable account on January 1, 2017: 6. A. $406,000 B. $471,000 C. $506,000 D. $503,000 E. $374,000 Assume the beginning balance on January 1,2017 in the Allowance for Doubtful Accounts is $15,000. If an aging schedule shows $30,000 to be uncollectible, then the a djusting entry on December 31, 2017 to record bad debts for the period would include: 7 A a credit to Accounts Receivable for $16,000 B. a credit to Allowance for Doubtful Accounts for $38,000 C. a debit to Bad Debt Expense for $2,000 D. a debit to Bad Debt Expense for $15,000 E. a credit to Allowance for Doubtful Accounts for $28,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts