Question: need help on the multiple choice questions Group Exercise: A company issued 10%, five-year bonds with a par value of $2,000,000, on January 1, 2014.

need help on the multiple choice questions

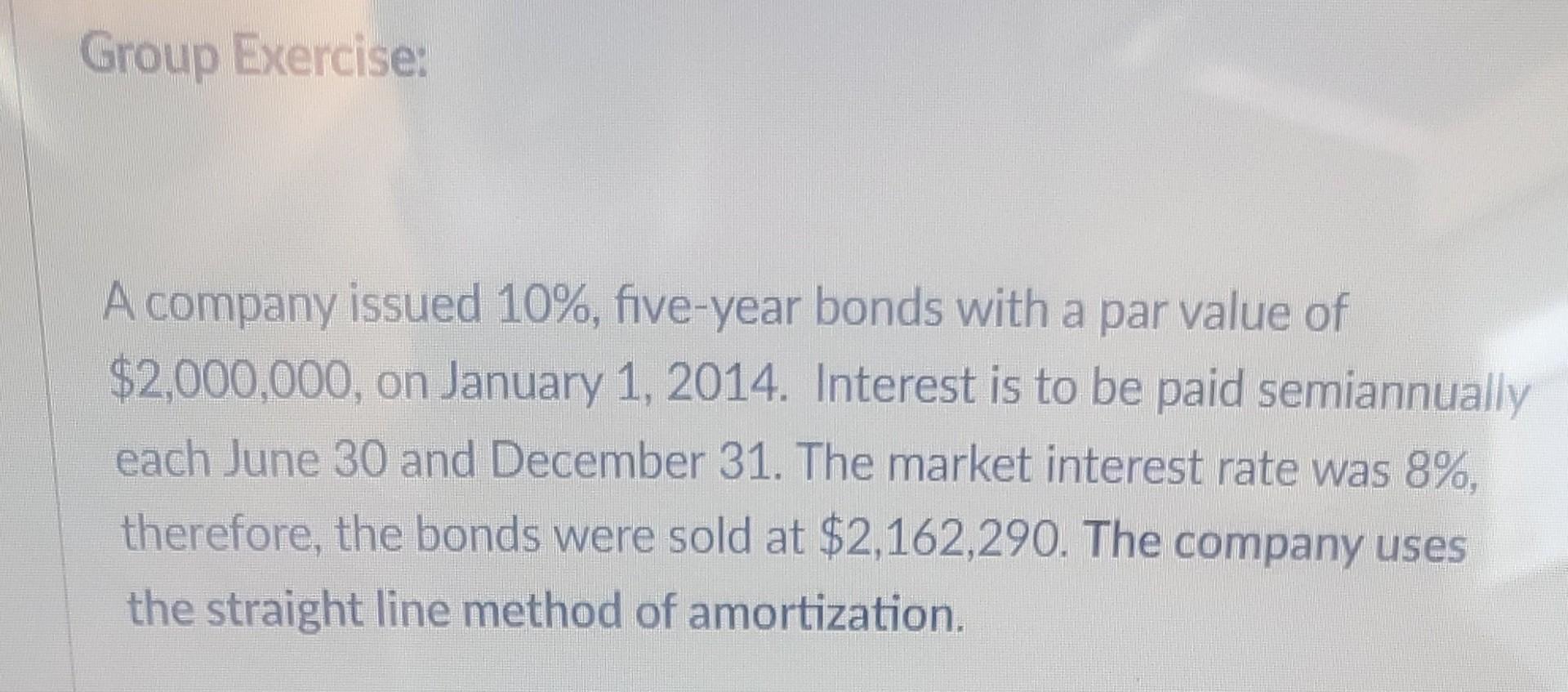

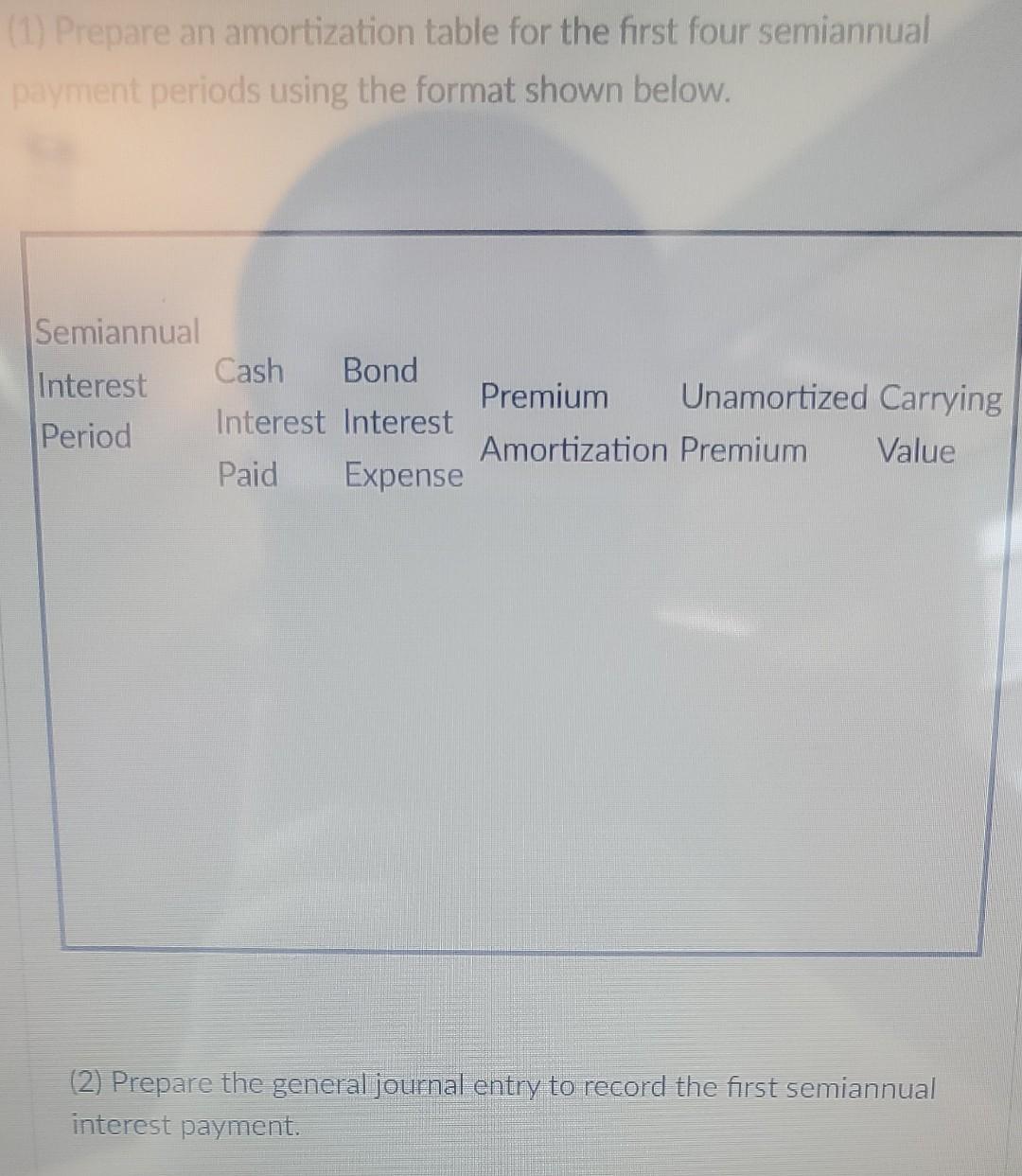

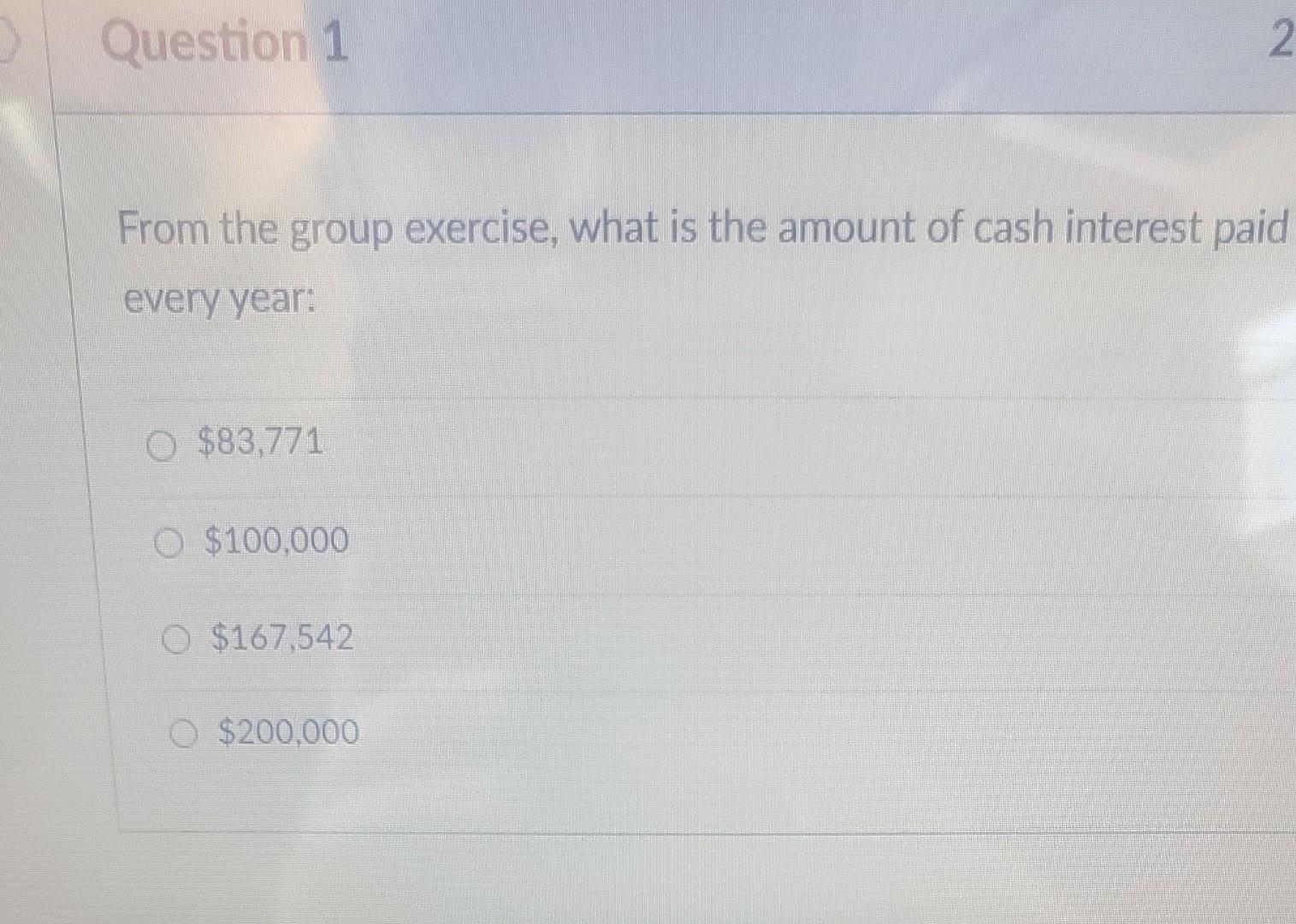

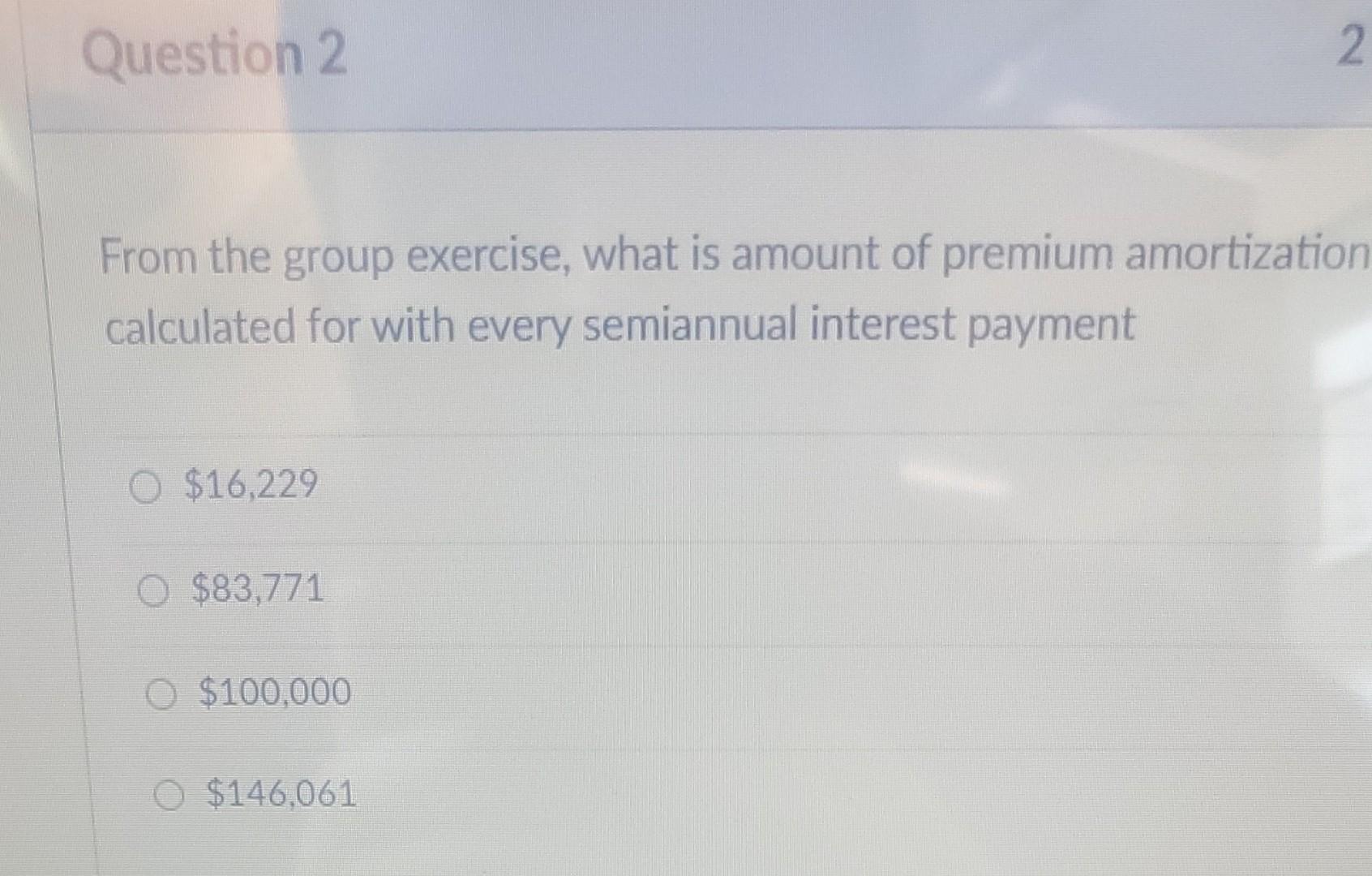

Group Exercise: A company issued 10%, five-year bonds with a par value of $2,000,000, on January 1, 2014. Interest is to be paid semiannually each June 30 and December 31. The market interest rate was 8%, therefore, the bonds were sold at $2,162,290. The company uses the straight line method of amortization. (1) Prepare an amortization table for the first four semiannual payment periods using the format shown below. Semiannual Interest Cash Bond Premium Unamortized Carrying Period Interest Interest Amortization Premium Value Paid Expense (2) Prepare the general journal entry to record the first semiannual interest payment. Question 1 2 From the group exercise, what is the amount of cash interest paid every year: $83,771 $100,000 $167,542 0 $200,000 Question 2 2 From the group exercise, what is amount of premium amortization calculated for with every semiannual interest payment $16,229 O $83,771 o $100,000 $146.061 Question 3 Refer to the data provided in the group exercise. What do you expect the carrying value to be at the maturity date of the bonds 0 $0 o $2.000.000 O 10% 8% 8 Question 4 A bond sells at a discount when the: Contract rate is above the market rate. Contract rate is equal to the market rate. Contract rate is below the market rate. Bond has a short-term life

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts