Question: need help on these 3 problems ! 21. Using the CAPM, what is the required rate of return on stock A given the following information?

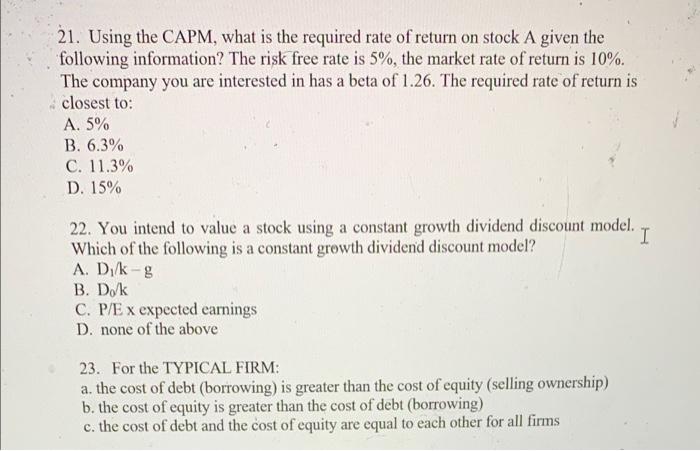

21. Using the CAPM, what is the required rate of return on stock A given the following information? The risk free rate is 5%, the market rate of return is 10%. The company you are interested in has a beta of 1.26. The required rate of return is closest to: A. 5% B. 6.3% C. 11.3% D. 15% 22. You intend to value a stock using a constant growth dividend discount model. I Which of the following is a constant growth dividend discount model? A. Dk-g B. DA C. P/E x expected earnings D. none of the above 23. For the TYPICAL FIRM: a. the cost of debt (borrowing) is greater than the cost of equity (selling ownership) b. the cost of equity is greater than the cost of debt (borrowing) c. the cost of debt and the cost of equity are equal to each other for all firms

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts