Question: Need help on these 4 multiple choice questions please! 2 Marks and has only one correct answer. 1. Which of the following is NOT an

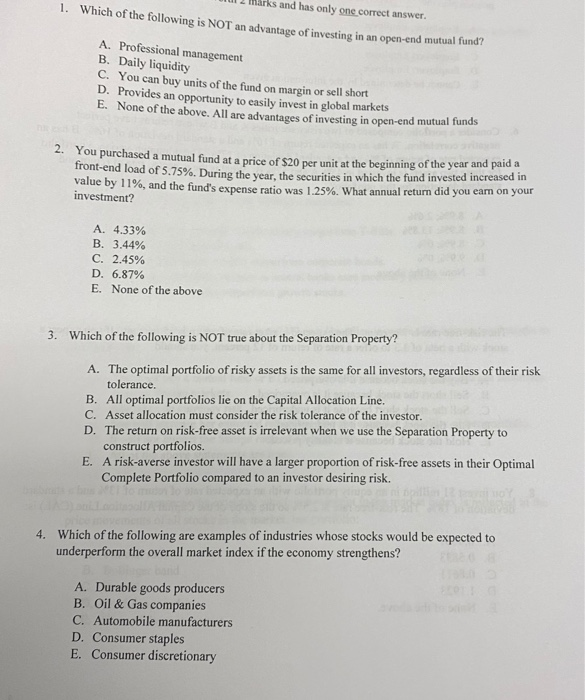

2 Marks and has only one correct answer. 1. Which of the following is NOT an advantage of investing in an open-end mutual fund A. Professional management B. Daily liquidity C. You can buy units of the fund on margin or sell short D. Provides an opportunity to easily invest in global markets E. None of the above. All are advantages of investing in open-end mutual funds rou purchased a mutual fund at a price of $20 per unit at the beginning of the year and paid a Tront-end load of 5.75%. During the year, the securities in which the fund invested increased in Value by 11%, and the fund's expense ratio was 1.25%. What annual return did you eam on your investment? A. 4.33% B. 3.44% C. 2.45% D. 6.87% E. None of the above 3. Which of the following is NOT true about the Separation Property? A. The optimal portfolio of risky assets is the same for all investors, regardless of their risk tolerance. B. All optimal portfolios lie on the Capital Allocation Line. C. Asset allocation must consider the risk tolerance of the investor. D. The return on risk-free asset is irrelevant when we use the Separation Property to construct portfolios. E. A risk-averse investor will have a larger proportion of risk-free assets in their Optimal Complete Portfolio compared to an investor desiring risk. 4. Which of the following are examples of industries whose stocks would be expected to underperform the overall market index if the economy strengthens? A. Durable goods producers B. Oil & Gas companies C. Automobile manufacturers D. Consumer staples E. Consumer discretionary

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts