Question: Need help on these 4 multiple choice questions please! es. With this type of 5. A company provides a Defined Contribution pension plan for its

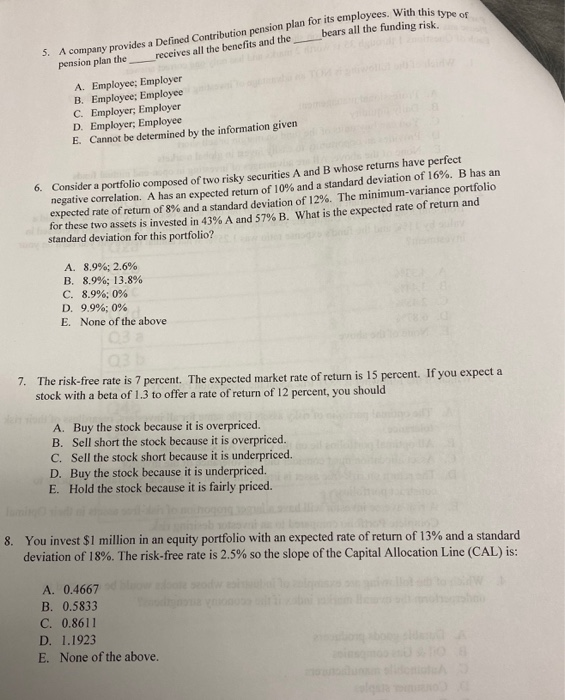

es. With this type of 5. A company provides a Defined Contribution pension plan for its employees. With this pension plan the receives all the benefits and the bears all the funding risk A. Employee; Employer B. Employee; Employee C. Employer; Employer D. Employer; Employee E Cannot be determined by the information given 6. Consider a portfolio composed of two risky securities A and B whose returns have perfect negative correlation. A has an expected return of 10% and a standard deviation of 16%. B has an expected rate of return of 8% and a standard deviation of 12%. The minimum-variance portfolio for these two assets is invested in 43% A and 57% B. What is the expected rate of return and standard deviation for this portfolio? A. 8.9%; 2.6% B. 8.9%; 13.8% C. 8.9%; 0% D. 9.9%; 0% E. None of the above 7. The risk-free rate is 7 percent. The expected market rate of return is 15 percent. If you expect a stock with a beta of 1.3 to offer a rate of return of 12 percent, you should A. Buy the stock because it is overpriced. B. Sell short the stock because it is overpriced. C. Sell the stock short because it is underpriced. D. Buy the stock because it is underpriced. E. Hold the stock because it is fairly priced. 8. You invest $1 million in an equity portfolio with an expected rate of return of 13% and a standard deviation of 18%. The risk-free rate is 2.5% so the slope of the Capital Allocation Line (CAL) is: A. 0.4667 B. 0.5833 C. 0.8611 D. 1.1923 E. None of the above

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts