Question: need help on these please 7. Th e increase in risk to equityholders when financial leverage is introduced is evidenced by: a. higher EPS as

need help on these please

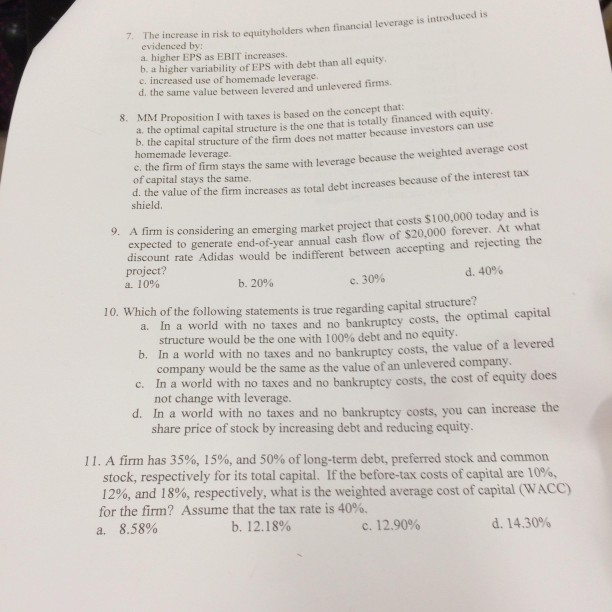

7. Th e increase in risk to equityholders when financial leverage is introduced is evidenced by: a. higher EPS as EBIT increases. b. a higher variability of EPS with debt than all equity c. increased use of homemade leverage d. the same value between levered and unlevered firms. 8. MM Proposition I with taxes is based on the concept that a. the optimal capital structure is the one that is totally financed with equity . the capital structure of the firm does not matter because investors can use homemade leverage e, the firm of firm stays the same with leverage because the weighted average cost of capital stays the same. d. the value of the firm increases as total debt increases because of the interest tax shield 9. A firm is considerin g an emerging market project that costs $100,000 today and is expected to generate end-of-year annual cash flow of $20,000 forever. At what discount rate Adidas would be indifferent between accepting and rejecting the project? a. 1090 b. 20% ?. 30% d. 4090 10. Which of the following statements is true regarding capital structure? the a. In a world with no taxes and no bankruptcy costs, tim structure would be the one with 100% debt and no equity. b. In a world with no taxes and no bankruptcy costs, the value of a levered orld with no taxes and no bankruptcy costs, the cost of equity does d. In a world with no taxes and no bankruptcy costs, you can increase the company would be the same as the value of an unlevered company In a w not change with leverage. c. share price of stock by increasing debt and reducing equity. 11. A firm has 35%, 15%, and 50% of long-term debt, preferred stock and common stock, respectively for its total capital. If the before-tax costs of capital are 10%, 12%, and 18%, respectively, what is the weighted average cost of capital (WACC) for the firm? Assume that the tax rate is 40%. a. 8.58% b. I 218% ?. 12.90% d. 14.30%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts