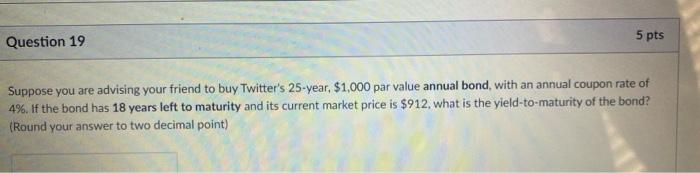

Question: need help on this 3 questions Question 19 5 pts Suppose you are advising your friend to buy Twitter's 25-year. $1,000 par value annual bond,

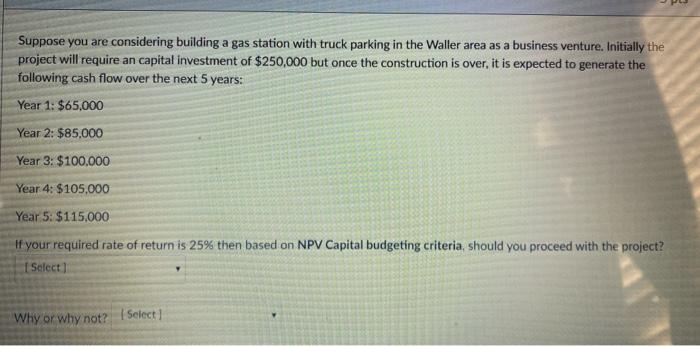

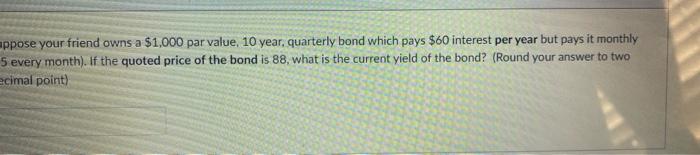

Question 19 5 pts Suppose you are advising your friend to buy Twitter's 25-year. $1,000 par value annual bond, with an annual coupon rate of 4%. If the bond has 18 years left to maturity and its current market price is $912, what is the yield-to-maturity of the bond? (Round your answer to two decimal point) Suppose you are considering building a gas station with truck parking in the Waller area as a business venture. Initially the project will require an capital investment of $250,000 but once the construction is over, it is expected to generate the following cash flow over the next 5 years: Year 1: $65,000 Year 2: $85,000 Year 3: $100,000 Year 4: $105,000 Year 5: $115,000 If your required rate of return is 25% then based on NPV Capital budgeting criteria, should you proceed with the project? Select) Why or why not? | Select 1 appose your friend owns a $1,000 par value, 10 year, quarterly bond which pays $60 interest per year but pays it monthly S every month). If the quoted price of the bond is 88, what is the current yield of the bond? (Round your answer to two ecimal point)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts