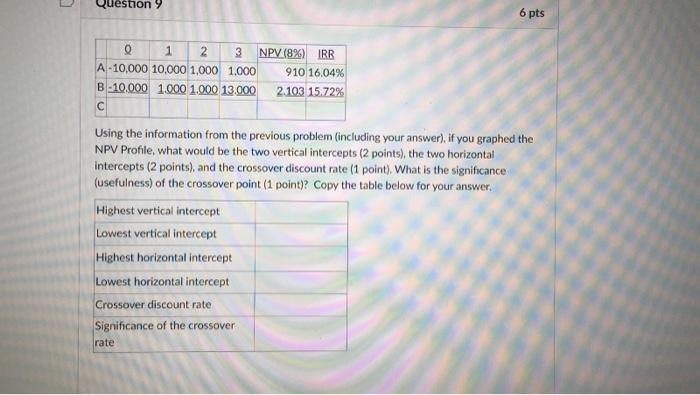

Question: need help on this please Question 9 6 pts 0 1 2 3 NPV (8%) IRR A -10,000 10,000 1.000 1.000 910 16.04% B -10.000

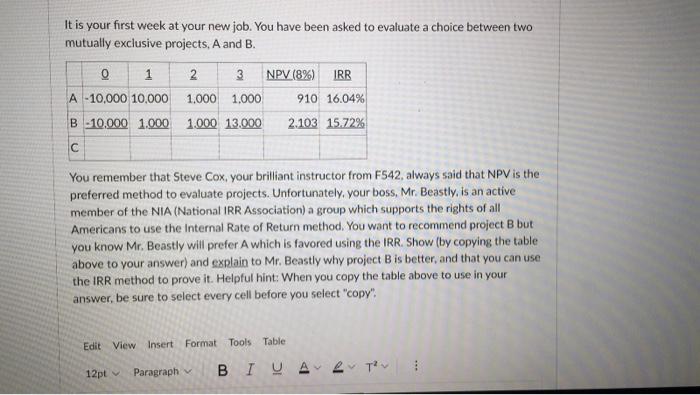

Question 9 6 pts 0 1 2 3 NPV (8%) IRR A -10,000 10,000 1.000 1.000 910 16.04% B -10.000 1.000 1.000 13.000 2.103 15.72% Using the information from the previous problem (including your answer), if you graphed the NPV Profile, what would be the two vertical intercepts (2 points), the two horizontal intercepts (2 points), and the crossover discount rate (1 point). What is the significance (usefulness) of the crossover point (1 point)? Copy the table below for your answer. Highest vertical intercept Lowest vertical intercept Highest horizontal intercept Lowest horizontal intercept Crossover discount rate Significance of the crossover rate It is your first week at your new job. You have been asked to evaluate a choice between two mutually exclusive projects, A and B. 0 1 2 3 NPV (8%) IRR A -10,000 10,000 1.000 1.000 910 16.04% B -10.000 1.000 1.000 13.000 2.103 15.72% You remember that Steve Cox, your brilliant instructor from F542, always said that NPV is the preferred method to evaluate projects. Unfortunately, your boss, Mr. Beastly, is an active member of the NIA (National IRR Association) a group which supports the rights of all Americans to use the Internal Rate of Return method. You want to recommend project B but you know Mr. Beastly will prefer A which is favored using the IRR. Show (by copying the table above to your answer) and explain to Mr. Beastly why project B is better, and that you can use the IRR method to prove it. Helpful hint: When you copy the table above to use in your answer, be sure to select every cell before you select "copy". Edit View Insert Format Tools Table 12pt Paragraph BIVA e Tv

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts