Question: Need help on this problem please help me on this question that would be great. Thanks 10. A) MB Development company is evaluating an investment

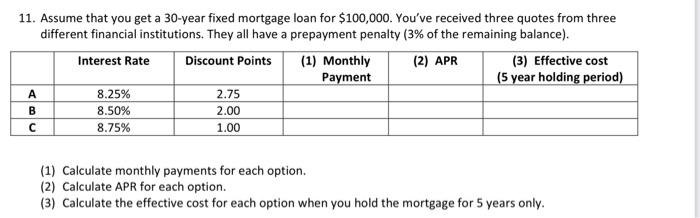

11. Assume that you get a 30-year fixed mortgage loan for $100,000. You've received three quotes from three different financial institutions. They all have a prepayment penalty (3% of the remaining balance). Interest Rate Discount Points (1) Monthly (2) APR (3) Effective cost Payment (5 year holding period) 8.25% 2.75 8.50% 2.00 8.75% 1.00 B (1) Calculate monthly payments for each option. (2) Calculate APR for each option. (3) Calculate the effective cost for each option when you hold the mortgage for 5 years only

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts