Question: Need help on this question.. E5-7 During 2024, its first year of operations, Pave Construction provides services on account of $160,000. By the end of

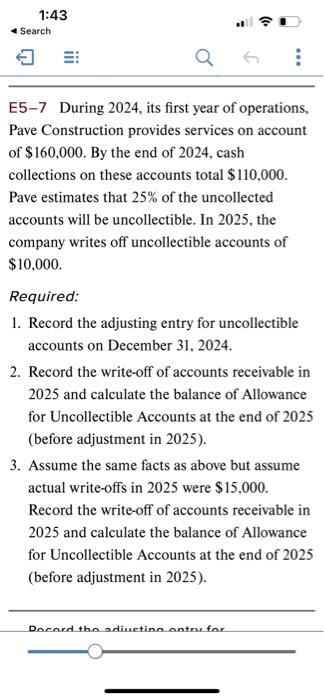

E5-7 During 2024, its first year of operations, Pave Construction provides services on account of $160,000. By the end of 2024 , cash collections on these accounts total $110,000. Pave estimates that 25% of the uncollected accounts will be uncollectible. In 2025 , the company writes off uncollectible accounts of $10,000 Required: 1. Record the adjusting entry for uncollectible accounts on December 31, 2024. 2. Record the write-off of accounts receivable in 2025 and calculate the balance of Allowance for Uncollectible Accounts at the end of 2025 (before adjustment in 2025). 3. Assume the same facts as above but assume actual write-offs in 2025 were $15,000. Record the write-off of accounts receivable in 2025 and calculate the balance of Allowance for Uncollectible Accounts at the end of 2025 (before adjustment in 2025)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts