Question: Need help on this question, thanks. Problem 3. We consider the standard Black-Scholes financial market consisting of two assets. The riskless asset has time-t price

Need help on this question, thanks.

Need help on this question, thanks.

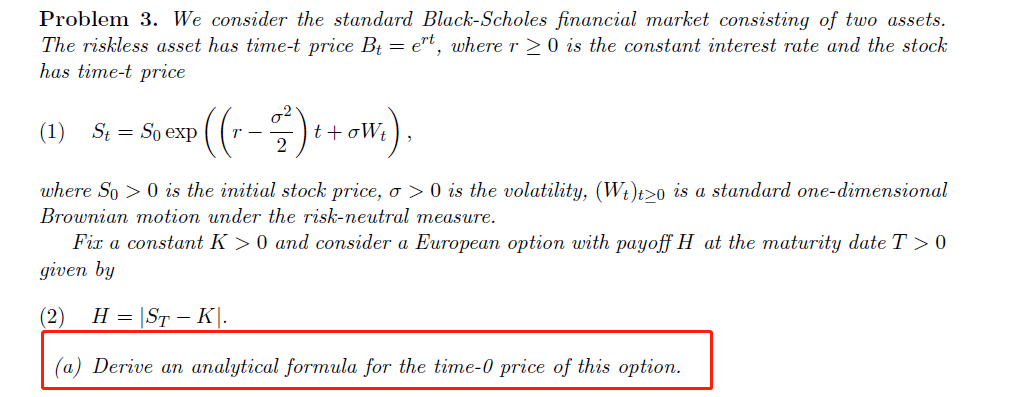

Problem 3. We consider the standard Black-Scholes financial market consisting of two assets. The riskless asset has time-t price Bt = et, where r> 0 is the constant interest rate and the stock has time-t price (1) St = So exp ((-- t + OW where So > 0 is the initial stock price, o > 0 is the volatility, (W+)t>o is a standard one-dimensional Brownian motion under the risk-neutral measure. Fix a constant K > 0 and consider a European option with payoff H at the maturity date T > 0 given by 2 H= ST-KU. (a) Derive an analytical formula for the time-0 price of this option. Problem 3. We consider the standard Black-Scholes financial market consisting of two assets. The riskless asset has time-t price Bt = et, where r> 0 is the constant interest rate and the stock has time-t price (1) St = So exp ((-- t + OW where So > 0 is the initial stock price, o > 0 is the volatility, (W+)t>o is a standard one-dimensional Brownian motion under the risk-neutral measure. Fix a constant K > 0 and consider a European option with payoff H at the maturity date T > 0 given by 2 H= ST-KU. (a) Derive an analytical formula for the time-0 price of this option

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts