Question: Need help on this study guide problem. please help ASAP! Thank you OF LIVE 5. Jasper Metals is considering installing a new molding machine which

Need help on this study guide problem. please help ASAP! Thank you

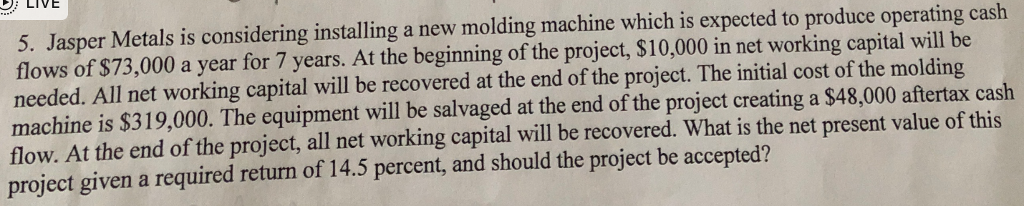

OF LIVE 5. Jasper Metals is considering installing a new molding machine which is expected to produce operating cash flows of $73,000 a year for 7 years. At the beginning of the project, $10,000 in net working capital will be needed. All net working capital will be recovered at the end of the project. The initial cost of the molding machine is $319,000. The equipment will be salvaged at the end of the project creating a $48,000 aftertax cash flow. At the end of the project, all net working capital will be recovered. What is the net present value of this project given a required return of 14.5 percent, and should the project be accepted

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts