Question: Need help ONLY with #2, I know the discount is 135,897 and that Cash is 1,400,00 and the Interest Expense is 1,535,897. I want to

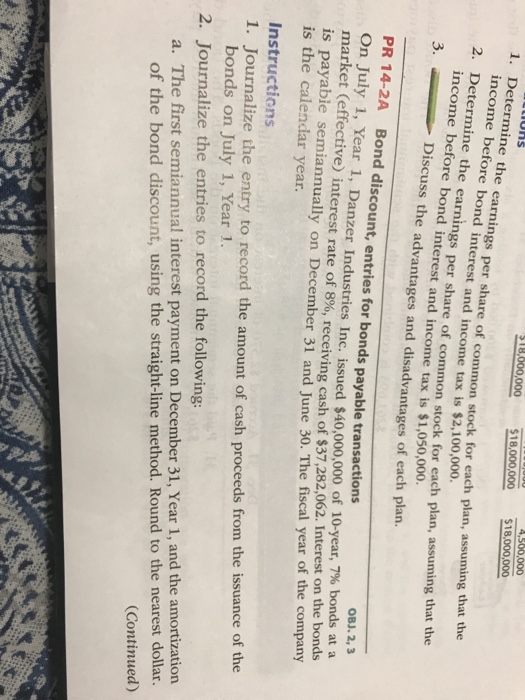

18,000,000 $18,000,000 000,000 etermine the earnings per share of common stock for each plan, assuming that the income before bond interest and income tax is $2,100,000. 2. Determine the earnings p income before bond interest and income tax is $1,050,000. er share of common stock for each plan, assuming that the 3. Discuss the advantages and disadvantages of each plan. PR 14-2A Bond discount, entries for bonds payable transactions OBJ. 2,3 n July 1, Year 1, Danzer Industries Inc. issued $40,000,000 of 10-year, 7% bonds at a market (effective) interest rate of 8%, receiving cash of $37,282,062. Interest on the bonds is payabie semiannually on December 31 and June 30. The fiscal year of the company is the calendar year. Instructions 1. Journal ize the entry to record the amount of cash proceeds from the issuance of the bonds on July 1, Year 1. 2. Journalize the entries to record the following: a. The first semiannual interest payment on December 31, Year 1, and the amortization of the bond discount, using the straight-line method. Round to the nearest dollar. Continued)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts