Question: ** need help only with standard deviation for b. i got 19.94% but that is wrong. Thanks in advance! Rate of Return if State Occurs

** need help only with standard deviation for b.

** need help only with standard deviation for b.

i got 19.94% but that is wrong.

Thanks in advance!

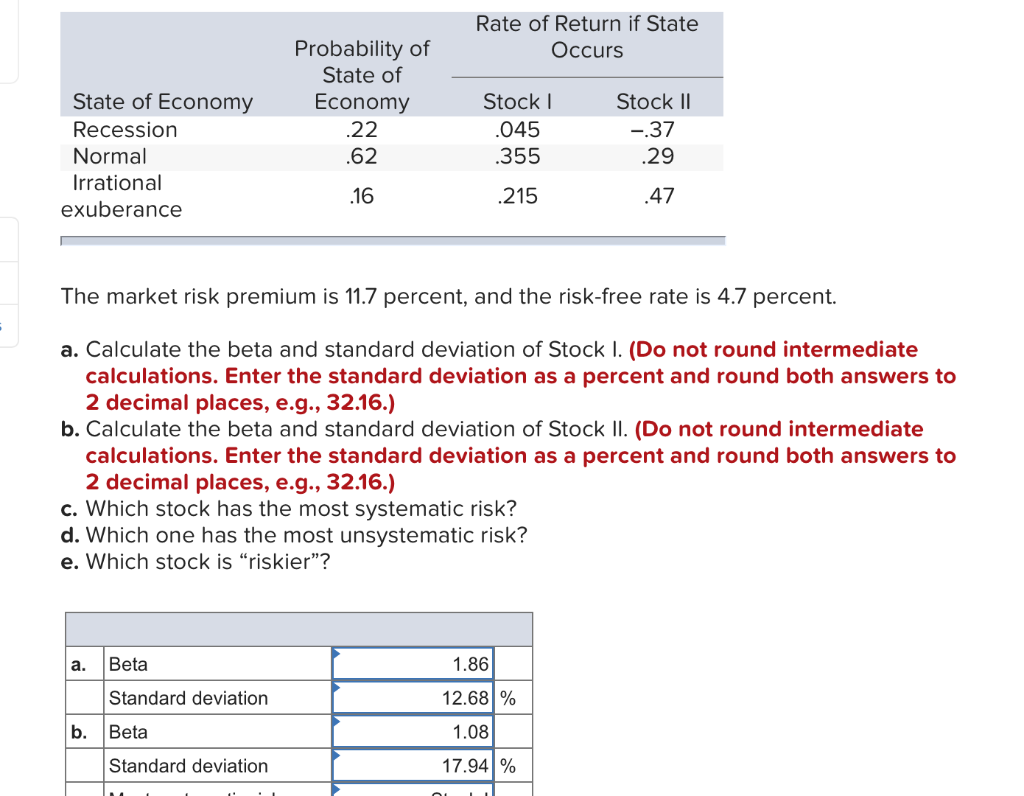

Rate of Return if State Occurs Probability of State of Economy .22 State of Economy Recession Normal Irrational exuberance .62 .16 Stock .045 .355 .215 Stock II -.37 .29 .47 The market risk premium is 11.7 percent, and the risk-free rate is 4.7 percent. a. Calculate the beta and standard deviation of Stock I. (Do not round intermediate calculations. Enter the standard deviation as a percent and round both answers to 2 decimal places, e.g., 32.16.) b. Calculate the beta and standard deviation of Stock II. (Do not round intermediate calculations. Enter the standard deviation as a percent and round both answers to 2 decimal places, e.g., 32.16.) c. Which stock has the most systematic risk? d. Which one has the most unsystematic risk? e. Which stock is "riskier"? a. Beta Standard deviation Beta Standard deviation 1.86 12.68% 1.08 17.94%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts