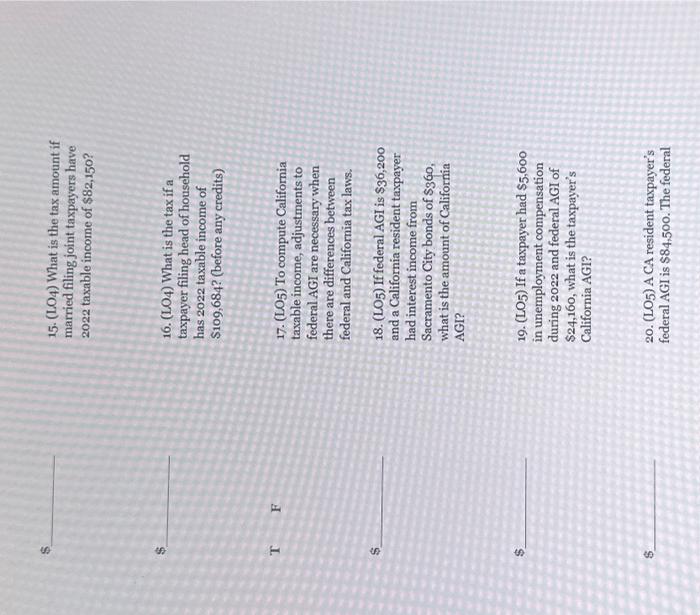

Question: need help please. 15. ( LO4) What is the tax amount if married filing joint taxpayers have 2022 taxable income of $82,150 ? 16. (LO4)

15. ( LO4) What is the tax amount if married filing joint taxpayers have 2022 taxable income of $82,150 ? 16. (LO4) What is the tax if a taxpayer filing head of household has 2022 taxable income of $109,684 ? (before any credits) 17. (LO5) To compute California taxable income, adjustments to federal AGI are necessary when there are differences between federal and Califormia tax laws. 18. (LO5) If federal AGI is $36,200 and a California resident taxpayer had interest income from Sacramento City bonds of $360, what is the amount of California AGI? 19. ( LO5 ) If a taxpayer had $5,600 in unemployment compensation during 2022 and federal AGI of $24,160, what is the taxpayer's California AGI? 20. (LO5) A CA resident taxpayer's federal AGI is $84,500. The federal

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts