Question: need help please Although Hank is retired, he is an excellent handyman and often works part time on small projects for neighbors and friends. Last

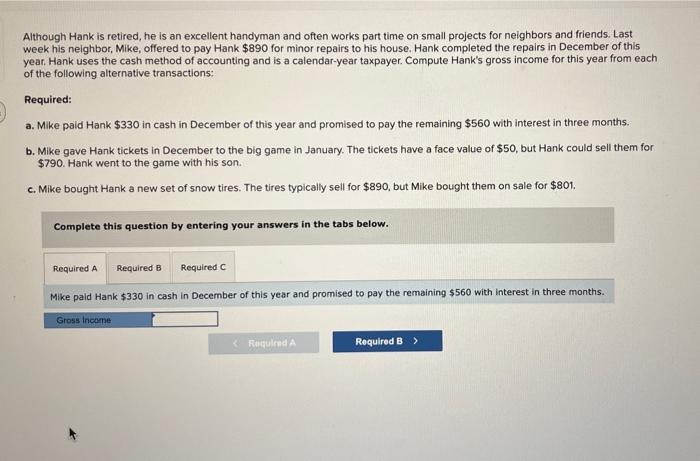

Although Hank is retired, he is an excellent handyman and often works part time on small projects for neighbors and friends. Last week his neighbor, Mike, offered to pay Hank $890 for minor repairs to his house. Hank completed the repairs in December of this year. Hank uses the cash method of accounting and is a calendar-year taxpayer. Compute Hank's gross income for this year from each of the following alternative transactions: Required: a. Mike paid Hank $330 in cash in December of this year and promised to pay the remaining $560 with interest in three months. b. Mike gave Hank tickets in December to the big game in January. The tickets have a face value of $50, but Hank could sell them for $790. Hank went to the game with his son. c. Mike bought Hank a new set of snow tires. The tires typically sell for $890, but Mike bought them on sale for $801. Complete this question by entering your answers in the tabs below. Mike paid Hank $330 in cash in December of this year and promised to pay the remaining $560 with interest in three months

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts