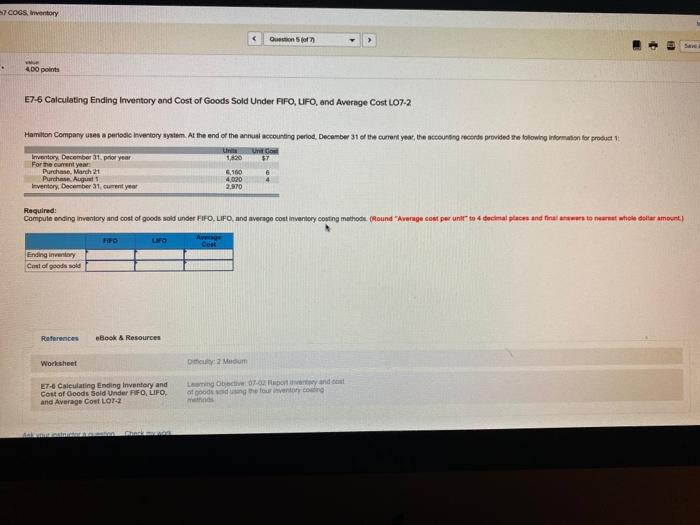

Question: need help please COGS. Inventory Oon . 400 points E7-6 Calculating Ending Inventory and Cost of Goods Sold Under FIFO, UFO, and Average Cost L07-2

COGS. Inventory Oon . 400 points E7-6 Calculating Ending Inventory and Cost of Goods Sold Under FIFO, UFO, and Average Cost L07-2 Hamilton Company cos periodic Inventory system. At the end of the auccounting period. December 31 of the current year, the accounting record provides the following Information for product 1.620 Union $7 Inventory December 31. prior year For the current year Purchase, March 21 Purchase. August Inventory, December 31, current year 160 4,020 2.970 4 Required: Compute ending inventory and cost of goods sold under FIFO, LIFO, and average cost inventory costing methods. Round "Average cost per unit to 4 decal places and also while dolar amount FIPO DOR Ending inventory Cost of goods sold References eBook & Resources Worksheet Duy Medium 27- Calculating Ending Inventory and Cost of Goods Sold Under FFO, LIFO, and Average Cost LOT-2 Legate.copy and can of goods and four inventory mi

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts