Question: Need help please due today!!! QUESTION 6. This is a blast from the past. IN GOOD FORM, prepare the follow statements for Dickinson Corp. for

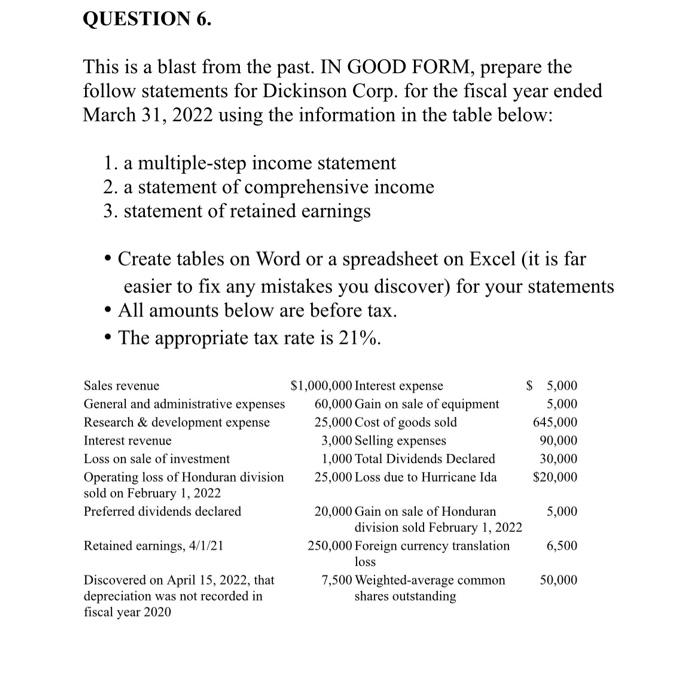

QUESTION 6. This is a blast from the past. IN GOOD FORM, prepare the follow statements for Dickinson Corp. for the fiscal year ended March 31, 2022 using the information in the table below: 1. a multiple-step income statement 2. a statement of comprehensive income 3. statement of retained earnings Create tables on Word or a spreadsheet on Excel (it is far easier to fix any mistakes you discover) for your statements All amounts below are before tax. The appropriate tax rate is 21%. Sales revenue $1,000,000 Interest expense $ 5,000 General and administrative expenses 60,000 Gain on sale of equipment 5,000 Research & development expense 25,000 Cost of goods sold 645,000 Interest revenue 3,000 Selling expenses 90,000 Loss on sale of investment 1,000 Total Dividends Declared 30,000 Operating loss of Honduran division 25,000 Loss due to Hurricane Ida $20,000 sold on February 1, 2022 Preferred dividends declared 20,000 Gain on sale of Honduran 5,000 division sold February 1, 2022 Retained earnings, 4/1/21 250,000 Foreign currency translation 6,500 loss Discovered on April 15, 2022, that 7,500 Weighted average common 50,000 depreciation was not recorded in shares outstanding fiscal year 2020 QUESTION 6. This is a blast from the past. IN GOOD FORM, prepare the follow statements for Dickinson Corp. for the fiscal year ended March 31, 2022 using the information in the table below: 1. a multiple-step income statement 2. a statement of comprehensive income 3. statement of retained earnings Create tables on Word or a spreadsheet on Excel (it is far easier to fix any mistakes you discover) for your statements All amounts below are before tax. The appropriate tax rate is 21%. Sales revenue $1,000,000 Interest expense $ 5,000 General and administrative expenses 60,000 Gain on sale of equipment 5,000 Research & development expense 25,000 Cost of goods sold 645,000 Interest revenue 3,000 Selling expenses 90,000 Loss on sale of investment 1,000 Total Dividends Declared 30,000 Operating loss of Honduran division 25,000 Loss due to Hurricane Ida $20,000 sold on February 1, 2022 Preferred dividends declared 20,000 Gain on sale of Honduran 5,000 division sold February 1, 2022 Retained earnings, 4/1/21 250,000 Foreign currency translation 6,500 loss Discovered on April 15, 2022, that 7,500 Weighted average common 50,000 depreciation was not recorded in shares outstanding fiscal year 2020

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts