Question: need help please E8-1, page 376; for each journal entry, also report the effects Dr E8-1 Bad debt expense is backed into; you know the

need help please

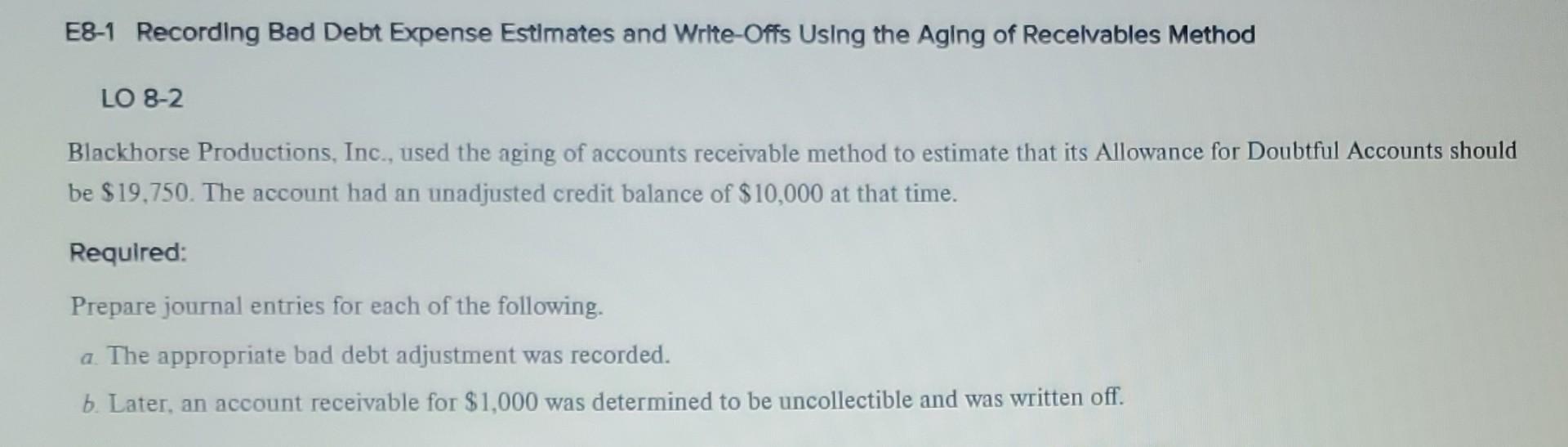

E8-1, page 376; for each journal entry, also report the effects Dr E8-1 Bad debt expense is backed into; you know the ending balance in the allowance, and you know the balance before the adjustment. If you have: Balance before adjustment=50 Ending balance = 120 Plug or back into Bad Debt expense: this will be 70 = 120 - 50 E8-1 Recording Bad Debt Expense Estimates and Write-Offs Using the Aging of Recelvables Method LO 8-2 Blackhorse Productions, Inc., used the aging of accounts receivable method to estimate that its Allowance for Doubtful Accounts should be $19.750. The account had an unadjusted credit balance of $10,000 at that time. Required: Prepare journal entries for each of the following. a. The appropriate bad debt adjustment was recorded. b. Later, an account receivable for $1,000 was determined to be uncollectible and was written off

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts