Question: Need help. Please explain how to calculate it. x 27.1 Study Exercise 11 (Algo) Imagine a bond that promises to make coupon payments of $100

Need help. Please explain how to calculate it.

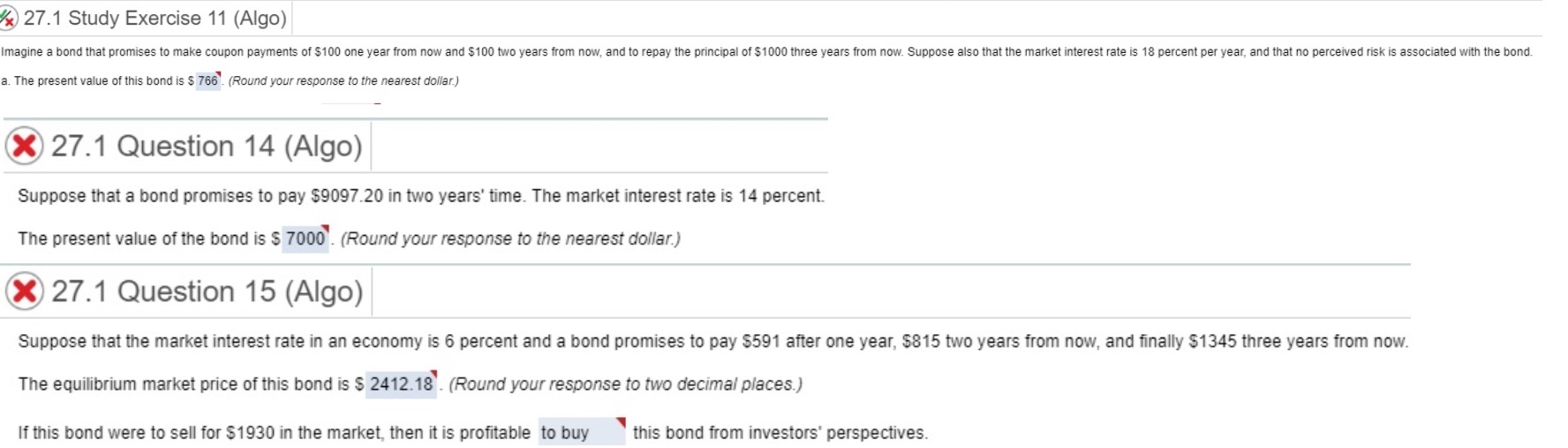

x 27.1 Study Exercise 11 (Algo) Imagine a bond that promises to make coupon payments of $100 one year from now and $100 two years from now, and to repay the principal of $1000 three years from now. Suppose also that the market interest rate is 18 percent per year, and that no perceived risk is associated with the bond. a. The present value of this bond is $ 766 . (Round your response to the nearest dollar.) X 27.1 Question 14 (Algo) Suppose that a bond promises to pay $9097.20 in two years' time. The market interest rate is 14 percent. The present value of the bond is $ 7000 . (Round your response to the nearest dollar.) X 27.1 Question 15 (Algo) Suppose that the market interest rate in an economy is 6 percent and a bond promises to pay $591 after one year, $815 two years from now, and finally $1345 three years from now. The equilibrium market price of this bond is $ 2412.18 . (Round your response to two decimal places.) If this bond were to sell for $1930 in the market, then it is profitable to buy this bond from investors' perspectives

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts